Generous discount on FCA fines leads to call for UK law changes

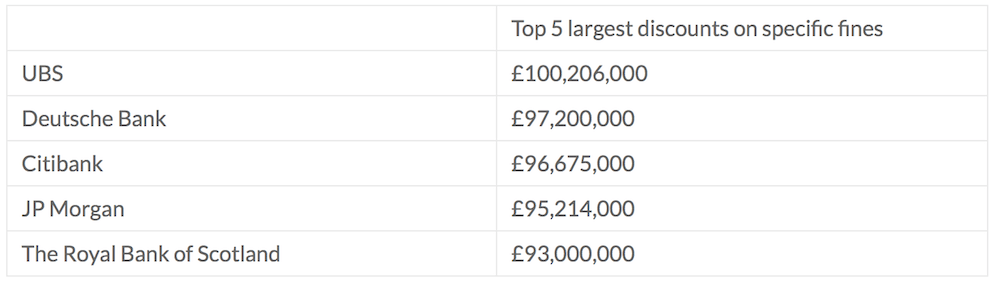

The top five discounts applied to individual fines concerned penalties for FX manipulation, according to New City Agenda think-tank.

UK banks and financial services firms have often made use of discounts in settlements with the UK Financial Conduct Authority (FCA) over the past four years, with the mechanism spurring concerns and calls for legislative changes.

According to data from the New City Agenda think-tank, UK banks and financial services firms have benefited from a total discount of £1.2 billion on FCA financial penalties between 2013 and 2017. Companies that are subject to enforcement action by the FCA can receive discounts of as much as 30% on their fines if they settle the case.

During the period in question, the FCA levied a total of 82 financial penalties. Out of these, 66 occasions firms received a 30% discount, on 8 occasions firms benefited from a 20% discount and on 8 occasions firms got no discount. Excluding the discounts, the fines would have been £4.2 billion, the think-tank estimates.

The top five discounts applied to individual fines were all to penalties for FX manipulation.

The heavy use of discounts has prompted calls for legislative changes. Lord Sharkey, a co-founder of the think-tank, has proposed an amendment to the Criminal Finances Bill which would oblige banks and other financial firms to take disciplinary action against the employee(s) responsible for the violation before they can receive the entire discount on an FCA fine.

According to Lord Sharkey, the amendment would permit the FCA “to have direct sight of the improvements in process and behaviour agreed in any settlement. It would enable it to see that appropriate disciplinary action had been taken against those responsible for the transgressions. It would give the settling firms a powerful incentive to fulfill any settlement conditions. It would do this by making part of any discount withholdable until the settling firm had satisfied the FCA that all appropriate disciplinary actions had been taken. Only then would the full discount be realised.”

According to Lord Sharkey, the amendment would permit the FCA “to have direct sight of the improvements in process and behaviour agreed in any settlement. It would enable it to see that appropriate disciplinary action had been taken against those responsible for the transgressions. It would give the settling firms a powerful incentive to fulfill any settlement conditions. It would do this by making part of any discount withholdable until the settling firm had satisfied the FCA that all appropriate disciplinary actions had been taken. Only then would the full discount be realised.”

Lord Sharkey has referred to a survey by the Banking Standards Board, which has found that 12% of bank employees had seen instances where unethical behaviour had been rewarded, whereas 13% saw it as difficult to grow their careers without “flexing ethical standards”.