Germany’s BaFin to keep in place restrictions on CFD trading

By a general administrative act, the regulator has stipulated that CFDs with an additional payments obligation are to remain prohibited.

The Federal Financial Supervisory Authority of Germany (BaFin) has earlier today announced that it will maintain the restrictions on the marketing, distribution and sale of financial CFDs to retail clients in Germany. By a general administrative act, the regulator has stipulated that contracts with an additional payments obligation are to remain prohibited. Germany’s supervisor has also specified maximum permissible leverage, negative balance protection, a restriction on the incentives offered to trade CFDs and a requirement for risk warnings.

In taking this step, BaFin is once again addressing the considerable investor protection concerns expressed at the time of its initial prohibition regarding CFDs with an additional payments obligation. This prohibition was introduced in May 2017. BaFin considers these CFDs in particular to carry an incalculable risk of loss for retail investors. Losses are not limited to the client’s capital investment but instead may encompass the entirety of their assets and can amount to multiples of the invested capital.

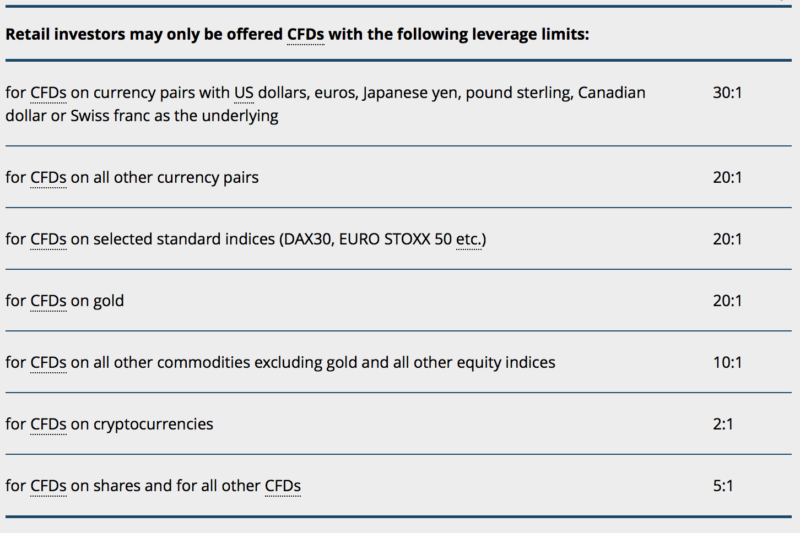

In order to further reduce the risks for retail investors, the leverage limits and other negative balance protections stipulated by ESMA will also continue to apply in Germany. Upon expiry of this measure, the level of protection in Germany will be aligned with the European standard by means of BaFin’s General Administrative Act. According to BaFin, standardised risk warnings are essential as well. The supervisor also maintains that retail investors must not be encouraged to enter into the risks associated with CFDs through initial credit, discounts, bonuses or other incentives.

One can view the restrictions on leverage in the table below:

Further, CFD brokerages must ensure that CFDs are automatically closed in the event of significant negative price performance. This protective mechanism takes effect when the value of a CFD equals less than half of the investor’s initial margin (margin close-out rule).

The trading companies must also guarantee that investors cannot lose more than the value of their initial margin (negative balance protection). Retail investors are therefore not required to make additional payments.

If offerers advertise CFDs to retail investors, they must expressly state how many private customers lose money with the products (risk warnings).