GKFX alters leverage as US election nears

At the close of London trading on Friday 4th November 2016 (17:00 UK time) the margin requirements will be raised on certain instruments

Another retail FX brokerage that is taking the cautious line in the advent of the US election is Turkish-owned, British market-focused GKFX.

On Tuesday, 8th November 2016 the USA will cast their votes on who will become the 45th President of the United States. The two candidates, Hillary Clinton (Democrats) and Donald Trump (Republicans) are very close in the pre-election polls, either result could have huge repercussions for the major markets.

GKFX considers that an increase in volatility could potentially have a negative impact on its clients’ trading and any open positions that they might hold.

On this basis, GKFX advises customers to make sure that their trading account is adequately capitalised. The company suggests that this is done in advance to ensure that customers can support their trading strategy through any fluctuations.

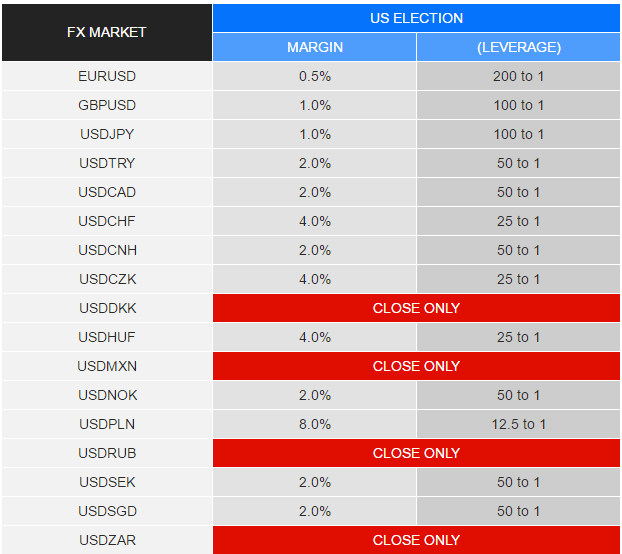

At the close of London trading on Friday 04th November 2016 (17:00 UK time) the margin requirements will be raised on the products mentioned in the table below.

Products like EURUSD will be set to a 0.5% margin requirement (Leverage 1:200) across all servers. Products like USDMXN will be set to ‘close-only’, where active positions can be managed and closed out but no additional positions can be opened.