Global Brokerage pushes for seamless transition into Chapter 11, aims to pay Trade Claims

Global Brokerage seeks interim authority to pay prepetition amounts owed on account of Trade Claims to various third-party providers of services.

As some of you must be aware, Global Brokerage Inc (NASDAQ:GLBR), formerly known as FXCM Inc, filed for Chapter 11 bankruptcy at the New York Southern Bankruptcy Court on December 11, 2017. FinanceFeeds is closely examining the raft of documents submitted by the company (“Debtor”) with the Court.

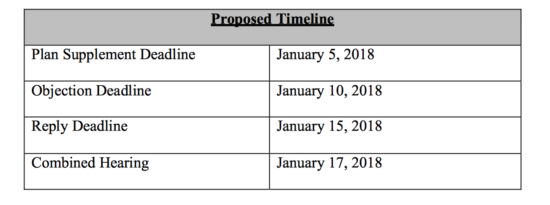

What is apparent is that Global Brokerage is pushing for a swift and seamless transition into Chapter 11. According to the schedule proposed by the company, a combined hearing should be held on January 17, 2018.

The aim is to preserve the Debtor’s business and quickly effectuate the restructuring embodied in the restructuring agreement and the Chapter 11 plan. During what Global Brokerage anticipates will be a short Chapter 11 Case, operations must continue in the ordinary course of business to preserve the value of the business and implement the reorganization transaction. Accordingly, the company has filed a number of First Day Pleadings designed to facilitate its transition into this Chapter 11 Case.

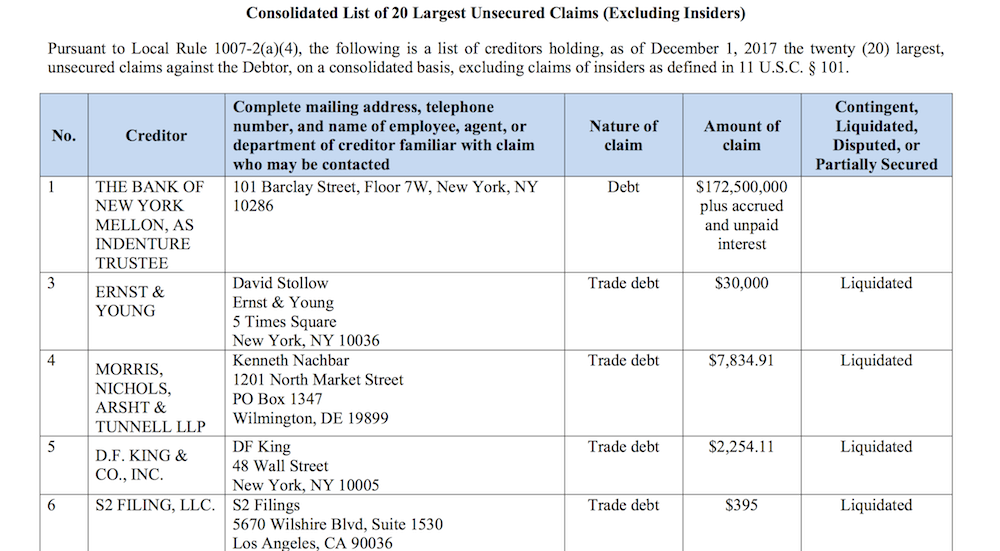

One important moment is the payment of Trade Claims. In the ordinary course of business, Global Brokerage incurred various fixed, liquidated, and undisputed payment obligations (Trade Claims) to various third-party providers of services (Trade Creditors). The Trade Claims include, but are not limited to, claims of (i) providers of services necessary to the Debtor’s business operations; (ii) providers of professional services including accounting and legal services; and (iii) other general operational expenses.

For the 12 months prior to filing the bankruptcy petition, Global Brokerage’s average aggregate monthly payment to Trade Creditors was about $250,000.

Global Brokerage is now seeking interim authority to pay prepetition amounts owed on account of Trade Claims in aggregate amount not to exceed $300,000, in the ordinary course of business. The Debtor requests authority to pay all Trade Claims in full in the ordinary course of business upon entry, and subject to the terms and conditions, of the final order.

Global Brokerage expects that all of its prepetition Trade Claims will become due and payable over the next four weeks. Accordingly, the company seeks authority to pay prepetition amounts owed on account of Trade Claims in full, in each case, in the ordinary course of business and subject to the terms and conditions set forth in the proposed order without any limitation in amount other than the overall aggregate capped amount of $300,000.

Global Brokerage argues that if it was limited to an interim cap, it would be forced to delay payments to certain of its vendors, which would be disruptive to its business, or seek emergency relief. Given the prepackaged nature of this Chapter 11 Case and the unimpaired treatment of General Unsecured Creditors under the Plan, Global Brokerage requests that the Court authorize payment of all prepetition amounts in the ordinary course of business upon entry of the interim order.

In addition, Global Brokerage is requesting to compensate the professionals it employs. The Debtor seeks authority to: (i) establish certain procedures to retain and compensate those professionals that the Debtor employs in the ordinary course of business (“Ordinary Course Professionals”), effective as of the Petition Date, without (a) the submission of separate employment applications or (b) the issuance of separate retention orders for each individual Ordinary Course Professional, and (ii) compensate and reimburse such professionals without individual fee applications.

The Ordinary Course Professionals provide to Global Brokerage professional services relating to litigation, regulatory matters, general corporate matters, and tax and accounting matters, as well as other issues and matters that have a direct and significant impact on the Debtor’s day-to-day operations as a public company.

Global Brokerage argues that it is essential that the employment of the Ordinary Course Professionals, many of whom are familiar with the company’s business, be continued to avoid disruption of the Debtor’s operations.

In conclusion, FinanceFeeds offers a screenshot of the list of unsecured claims. The picture below shows six names (instead of 20), as the other 14 rows in the table are empty.