Global Collaboration: European Tokenization Platform VNX Partners with South Korean Blockchain Leader Lambda256

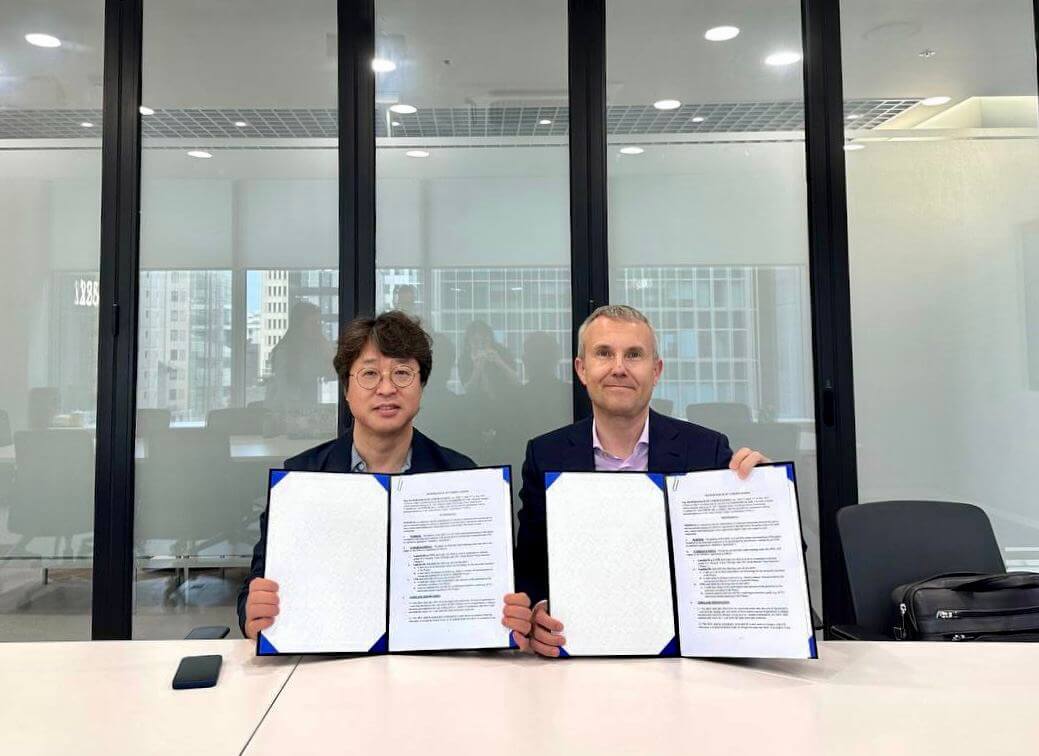

VNX, a European tokenization platform, and Lambda256, a South Korean blockchain leader, have formed a strategic partnership to develop a global security token offering (STO) business, bridging the gap between traditional and crypto assets across continents.

European tokenization platform VNX and Lambda256, the blockchain technology arm of South Korean fintech leader Dunamu, have announced a strategic partnership to co-develop a global security token offering (STO) business. The association represents a transcontinental bridge between Korea and Europe, providing customers with comprehensive services and seamless access to security and asset-backed tokens across multiple continents.

Leveraging the robust capabilities of its proprietary blockchain platform, Luniverse, Lambda256 has swiftly established a strong foothold in the domestic STO market. The partnership with VNX allows Lambda256, which has an impressive portfolio of over 2,000 corporate clients, to use VNX’s existing infrastructure and services, providing its customers with a secure, compliant, and efficient platform to reach a global investor base. Lambda256 will supply blockchain-based technology to VNX as part of this collaboration, while VNX will oversee operation and compliance guidance.

This strategic alliance will broaden Lambda256’s global STO and VNX’s asset-backed token business networks while enhancing their product offerings. VNX, headquartered in Europe with offices in Luxembourg and Liechtenstein, operates platforms that help bring traditional assets into the crypto world. VNX’s custom-made solution amalgamates technical infrastructure and integrated services such as KYC, compliance, and tokenization, facilitating seamless tokenization of various assets.

VNX has made significant strides in tokenization since launching its platform in Luxembourg in 2019. It has also found a company, registered with the Financial Market Authority (FMA) of Liechtenstein, which produces stablecoins backed by physical Gold (VNX Gold – VNXAU) and fiat referencing tokens: VNX Euro (VEUR) and VNX CHF (VCHF). These innovations address the existing gap of reliable assets in the crypto world.

Lambda256 has been at the forefront of the South Korean STO market as an eminent provider of blockchain cloud platforms in East Asia. It has cultivated STO businesses with major Korean securities firms such as Shinhan Investment Corp., Yuanta Securities, and Eugene Investment & Securities, following the release of STO regulatory guidelines by the Financial Services Commission of Korea in March.

“We are pleased to establish a strategic collaboration with VNX, a successful asset tokenization platform operating in Europe. The tokenized securities business should consider global markets with significant liquidity from the early stages. Lambda256 is actively preparing competitive technologies and business platforms that can support South Korean STO asset holders and securities firms looking to expand into overseas markets,” said Jo Won-ho, Head of STO Business at Lambda256.

Alexander Tkachenko, CEO and Founder of VNX, commented, “We are thrilled to partner with Lambda256 to develop an unparalleled global STO experience jointly. We aim to leverage existing infrastructure to offer customers access to various digital assets and services across continents.”

This collaboration is a significant step towards the future of global STO business and a testament to the growing impact of blockchain and tokenization on traditional finance. As Lambda256 and VNX continue to innovate and provide leading-edge solutions, they promise to redefine the landscape of digital assets and tokenized securities globally.

VNX (VNXLU) is a European company dedicated to integrating traditional assets into the crypto world. VNX’s end-to-end platform facilitates the complete lifecycle of digital assets, from planning to post-issuance support. In addition to tokenizing traditional assets, VNX has created the first European gold-backed tokens and fiat stablecoins, expanding investor capabilities. More information can be found at www.vnx.lu and www.vnx.li.

Lambda256 is the blockchain tech arm of Dunamu, offering a comprehensive portfolio of blockchain solutions via its cloud-based blockchain infrastructure and Web3 development platform, Luniverse. Lambda256 recently released Luniverse NOVA, a new version of its platform equipped with all necessary services to build Web3, NFT, and other blockchain services. Lambda256 has collaborated with over 4,000 clients in building, deploying, and managing blockchain networks at scale with Luniverse.