GMO Internet reports repurchase of 1.4m shares

The transactions were carried out in May 2019, with the aggregate cost of share repurchases being ¥2.36 billion.

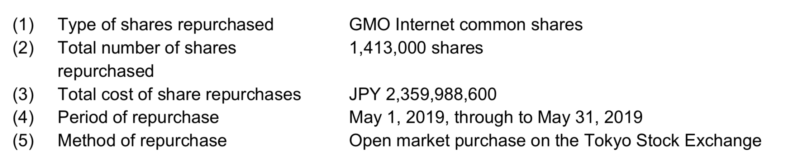

Japanese online services provider GMO Internet Inc. (TYO:9449) has earlier today reported transactions in its own shares. From May 1, 2019 to May 31, 2019, GMO Internet repurchased 1,413,000 shares, with the total cost being JPY 2,359,988,600.

The company repurchased its own shares in line with resolutions passed at the Board of Directors meeting held on February 12, 2019. Back then, GMO Internet’s Board of Directors determined that the company would repurchase up to 2.5 million shares for a total sum of up to JPY 3,110 million. The period of the repurchase was set for February 13, 2019, through to December 30, 2019.

GMO Internet has sought to demonstrate a clear commitment toward returning value to shareholders through its dividend policy. Under the policy, the company aims to return 50% of profits to shareholders. GMO’s target dividend payout ratio is a minimum of 33% of profit attributable to owners of parent, while the company will aim to allocate the remainder of the 50% of profit attributable to owners of parent to the acquisition of treasury stock after taking into consideration business results and financial condition, and taking a flexible approach in accordance with share price.

GMO Internet has also adopted a quarterly dividend system to enable prompt profit return to shareholders. For the first quarter of 2019, the company said it will pay a quarterly dividend of ¥6.00 per share for the current quarter (34.1% payout ratio). As for the second quarter, GMO intends to pay dividends in accordance with the Total Shareholder Returns Policy.