Growth in client trading activity triggers rise in IG Group’s revenues in Q3 FY18

The broker says it has made good progress with the actions being taken to mitigate the potential financial impact of the regulatory change planned by ESMA.

Higher trading activity of clients has boosted revenues of electronic trading major IG Group Holdings plc (LON:IGG) in the third quarter of the Group’s financial year. According to a filing with the London Stock Exchange made earlier today, IG has delivered record revenues in the three months to February 28, 2018.

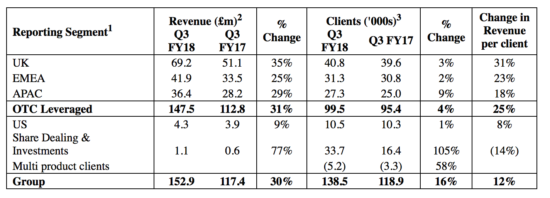

Net trading revenue of £152.9 million in the third quarter of FY2018, up 30% from the equivalent period in the prior year. The result was 13% ahead of the Company’s previous record revenue quarter of £135.2 million in Q1 FY2018.

Revenue in the third quarter was bolstered by a high level of client trading activity, and from a growth in the number of active clients. OTC leveraged revenue per client of £1,482 in the quarter was 25% higher than in the same period a year earlier. The number of unique OTC leveraged clients active in the period of 99,500 was 4% higher than in the prior year, including 12,500 new OTC leveraged clients who traded for the first time in the period.

Let’s note that client trading in cryptocurrencies accounted for 11% of revenue in the period (this compares with 1% in Q3 FY17), however, cryptocurrency trading by clients has slowed markedly since the end of January.

Regarding the numbers for the year to date – net trading revenue amounted to £421.3 million in the first three quarters of FY2018, up 16% higher than in the same period in the prior year.

Revenue growth has been solid across all regions and products. The UK remains in the lead. The 16% growth in OTC leveraged revenue compared with prior year reflects higher revenue per client, driven by an increase in client trading activity, combined with higher hedging efficiency.

Regarding outlook, IG says it remains difficult to forecast the level of revenue in the last quarter of the year, which depends on the level of trading opportunities available to our clients and on the Company’s hedging efficiency.

Concerning the changes in the regulatory landscape, IG notes ESMA’s consultation launched in the early part of the year. The broker expects that ESMA will soon publish measures to restrict the marketing, distribution or sale to retail clients of CFDs.

IG continues to believe that any financial impact from the implementation of such measures is unlikely to be significant in FY18. It remains difficult to predict what impact regulatory change may have on the business in subsequent financial years. The broker says it has made good progress with the actions being taken to mitigate the potential financial impact of regulatory change, and to position the business so that it will continue to deliver for all its stakeholders under a more restrictive regulatory environment.