Hong Kong broker Guotai Junan registers decrease in leveraged FX revenues in 2018

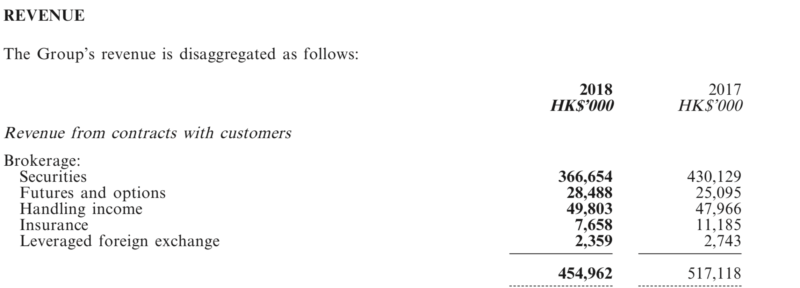

Leveraged foreign exchange contributed HK$2.36 million in revenues to the brokerage’s segment of Guotai Junan in 2018, down from from the HK$2.74 million generated in the preceding year.

Hong Kong-based online trading company Guotai Junan International Hold. Limited (HKG:1788) has earlier today posted its financial results for the year ended December 31, 2018, with the results lagging behind those recorded in 2017.

In 2018, the Group’s brokerage business registered a revenue of approximately HK$450 million, down from about HK$520 million registered in the preceding year. Excluding the effect of income arising from the listing of Guotai Junan’s parent company in 2017, brokerage income increased by 8% year-on-year. Leveraged foreign exchange contributed HK$2.36 million in revenues to the brokerage’s segment of Guotai Junan in 2018, down from from the HK$2.74 million generated in the preceding year.

Although the Hong Kong stock market experienced significant fluctuations during the year under review as Hang Seng Index fell 14% year-on-year but the Group’s competitive financial products and advanced services and platform such as the “Jun Hong Wealth Management Club” and the upgraded mobile trading platform “Tradego” attracted many high-quality customers. During the year, the number of professional investors (customers with investible assets of more than US$1 million) of the company increased steadily by approximately 40% year-on-year.

The stock market fluctuations led to an increase in trading volumes of futures and options. During the year under review, income arising from futures and options brokerage commission increased by 14% to approximately HK$28.5 million.

For the year ended December 31, 2018, the Group recorded a total revenue of approximately HK$3.01 billion, down by approximately 4% from the preceding year. Despite the market fluctuations, income from the Group’s financial products and debt capital market businesses continued to grow rapidly and recorded the historic high, rising by 111% year-on-year to HK$640 million and 38% year-on-year to HK$480 million, respectively.

Total profit attributable to equity holders of the company amounted to about HK$800 million in 2018, down from HK$1,230 million in 2017. This represents a decrease of approximately 35%. Excluding the effect of income (on brokerage and corporate finance businesses) arising from the listing of Guotai Junan Securities Co., Ltd. (stock code: 2611.HK/601211.SS) in 2017, the Profit Attributable to Shareholders decreased by 20% year-on-year.

The Board recommends the payment of a final dividend of HK$0.020 per share for the year ended December 31, 2018, subject to the approval by shareholders at the annual general meeting of the company.