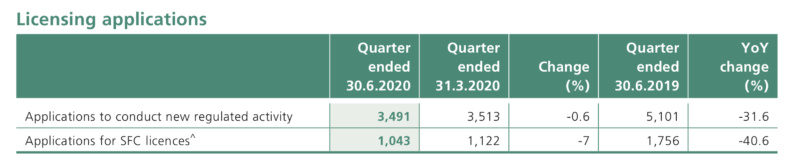

Hong Kong registers drop in applications for SFC licenses in Q2 2020

The decline is 7% in quarterly terms and 40.6% in annual terms.

Hong Kong’s Securities and Futures Commission (SFC) today published its latest Quarterly Report which summarises key developments from April to June 2020.

The document reveals a decrease in the number of applications for SFC licenses. In the second quarter of 2020, the regulator received 1,043 licence applications including 54 corporate applications. This is down 7% from the preceding quarter and 40.6% from the second quarter of 2019.

The number of licensees and registrants totalled 46,824, of which 3,109 were licensed corporations.

The SFC conducted 74 on-site inspections of licensed corporations to review their compliance with regulatory requirements.

The regulator authorised 41 unit trusts and mutual funds, including 28 funds domiciled in Hong Kong, and 24 unlisted structured investment products for public offering.

In terms of oversight, the SFC vetted 82 new listing applications, including three from pre-profit biotech companies. The SFC issued section 179 directions to gather additional information in 18 cases and wrote to detail its concerns in one transaction as part of its review of corporate disclosures.

During the quarter to end-June 2020, eight licensed corporations and two individuals were disciplined, resulting in total fines of $67.5 million. In terms of enforcement, let’s note that the SFC obtained disqualification orders in the Court of First Instance against eight individuals for breaches of their duties as listed company directors.

The regulator made 2,366 requests for trading and account records triggered by untoward price and turnover movements.