Hong Kong’s SFC sees new license applications decline in quarter to end-December 2018

The number of corporate applications for new licences decreased 25.9% from the preceding quarter to 63, down 35.7% year-on-year.

The Hong Kong Securities and Futures Commission (SFC) has earlier today published its Quarterly Report for the quarter to the end of December 2018.

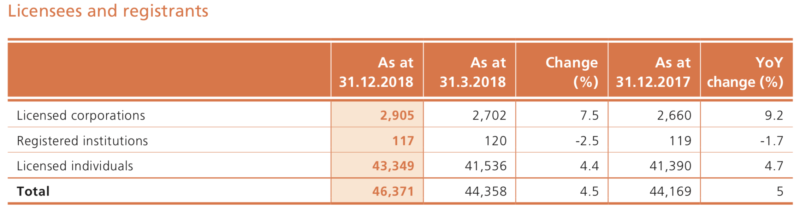

As at December 31, 2018, the number of licensees and registrants totalled 46,371, up 5% from last year, whereas the number of licensed corporations grew 9.2% to 2,905. During the final quarter of 2018, the SFC vetted 68 new listing applications, up 70% from 40 in the same quarter last year. In the nine months to December, the number of listing applications was 310, up 31.4% year-on-year.

In the quarter, the Hong Kong regulator received 1,953 new licence applications, down 17% from the preceding quarter and up 1.5% year-on-year. The number of corporate applications for new licences decreased 25.9% from the last quarter to 63, down 35.7% year-on-year.

The SFC has been subject to criticism due to the pace of reviewing licensing applications. In October 2018, the Process Review Panel (PRP) for the SFC published its annual report for 2017-18.

In 2017-18, PRP reviewed eight licensing cases. The processing time for these cases ranged from six months to 15 months.

PRP considered that the SFC Licensing Department had taken longer time than necessary to process an application. PRP suggested that the Department should review its process in light of the changing circumstances in the financial market. Also, it should streamline its workflow in order to cope with the workload arising from the growth in the number of licensees and a wider range of regulated activities carried out by the licensees.