How do you define your VIPs?

This is a guest editorial which has been composed by Pini Yakuel, CEO and founder of automated customer retention solutions company Optimove. Most brokers define their VIPs according to a fixed spend or activity amount, or by fixed percentiles (e.g., the top 5% of traders according to a given metric). Sometimes, the cut-off point is […]

This is a guest editorial which has been composed by Pini Yakuel, CEO and founder of automated customer retention solutions company Optimove.

Most brokers define their VIPs according to a fixed spend or activity amount, or by fixed percentiles (e.g., the top 5% of traders according to a given metric). Sometimes, the cut-off point is determined according to the staff and resources available for VIP management: you can handle only so much.

Defining the VIP group is a constant struggle. On the one hand, underestimation will result in the loss of important customers and customer value. On the other hand, overestimation will result in squandered marketing dollars.

Customer modeling is the best way to achieve a data-driven, real-time model of your VIPs that stays relevant with the dynamic nature of your business. If you are not using a customer retention solution you might like to try this Excel-based method for defining your VIPs.

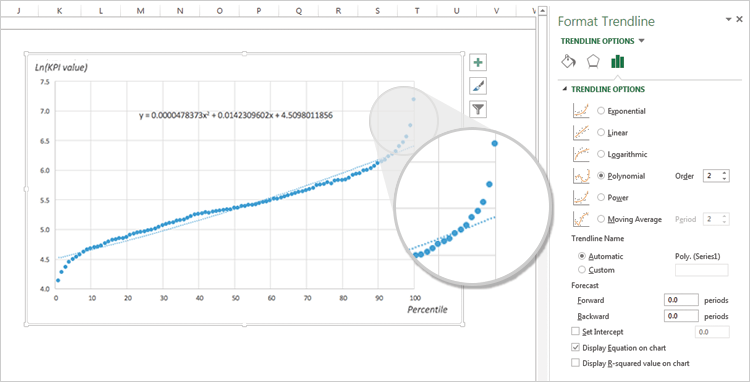

This method uses a LN transformation and trendline to identify data outliers. The percentiles which violate the trend at its extreme are those which do not adhere to what we would expect of them under “normal” circumstances. This is the dynamic group of outliers which make up your VIPs. This Excel-based technique offers flexibility in determining the extent of difference between regular customers and VIPs, and allows you to further explore this group in order to achieve a more granular understanding of VIP behavior.

Here’s how to go about it:

- After choosing a customer metric, divide your active customer base into 100 percentiles of average values, from lowest to highest (using only positive values larger than 1). The 100thpercentile will have the highest value.

- Calculate the values’ Logarithm (“LN”).

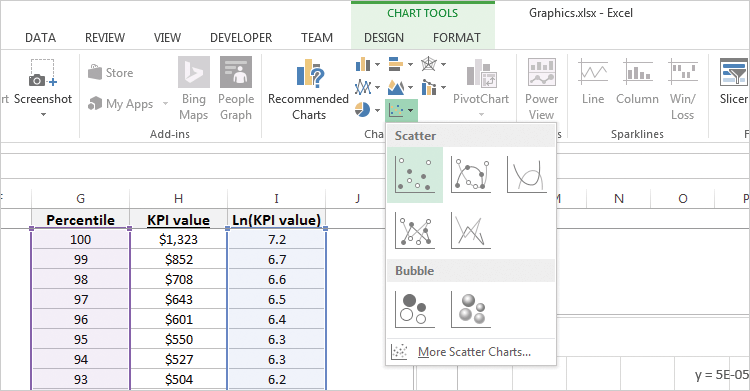

- Use a scatterplot to graph the percentiles (X) and LN values (Y).

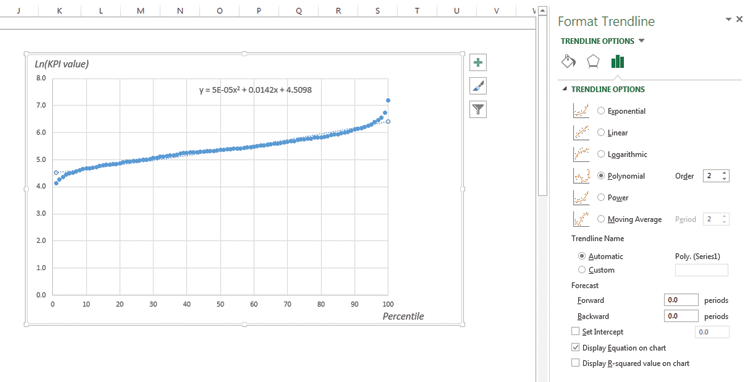

- Add a trendline and format it as polynomial of Order 2.

- The dots at the extreme right of the scatterplot violate the trend and are thus your “outliers,” your VIPs.

For a detailed presentation of this method and additional tips for achieving a more granular understanding of your VIP groups and their behavior, download A Better Way to Define your VIPs – A Step-by-Step Guide.

In a highly Pareto industry, VIPs are one businesses’ biggest assets. Making sure that you’re giving the right thought to this valuable segment should be one of your top priorities.