How Post-Trade works and how blockchain is a threat and savior to the FX industry

The European Central Bank (ECB) published a working paper to analyze distributed ledger technologies in securities post-trading. Studying its various specifications, unrestricted and restricted DLTs, validation methods, blockchain as database, consensus ledgers, and smart contracts, the official document then examines whether the adoption of DLTs is an evolution or revolution to the current post-trade landscape. […]

The European Central Bank (ECB) published a working paper to analyze distributed ledger technologies in securities post-trading. Studying its various specifications, unrestricted and restricted DLTs, validation methods, blockchain as database, consensus ledgers, and smart contracts, the official document then examines whether the adoption of DLTs is an evolution or revolution to the current post-trade landscape.

The Current Post-Trade Landscape

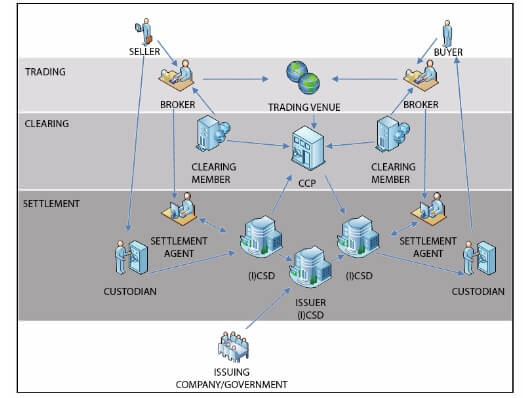

Establishing many different technological hypothetical scenarios, the paper acknowledged that post-trade processes in securities are likely to disrupt. Currently, the buyer and seller instruct their respective brokers about their trading orders, which are then routed to a trading venue when they can “cross” in the order book or an alternative system.

A clearing house then reconciles orders, possibly netting them with other pending instructions, and sometimes acts as the central counterparty (CCP) when it ‘nets by novation’. The clearing house informs brokers of their obligations and brokers instruct their settlement agents.

“The settlement agent of the seller’s broker receives the securities from the seller’s custodian into its account, and credits them to the clearing house – which, for simplicity, we assume to have accounts in both the investors’ central securities depositories (CSDs). The clearing house then issues an instruction or the securities to be credited to the account of the buyer’s settlement agent, who credits them to the buyer’s custodian.”

“It may be necessary to carry out a reconciliation between the investors’ CSDs and the issuer’s CSD, e.g. to allow the execution of the notary function and of asset servicing”, the paper concludes, informing that by using internalized settlement or via consolidation among intermediaries, the process may be simplified, but consolidation may lead to anticompetitive behavior, potentially creating natural or regulatory monopolies.

The future of post-trading with distributed ledger technologies (DLTs)

Taking in account that the impact of DLTs in the post-trading processes depends on the level of post-trade value chain, the type of governance they are subject to, and the willingness and legality to implement the innovation, the ECB paper analyzes the potential impact of DLTs on three different layers: settlement, custody, and clearing.

Then, the authors evaluated three scenarios to access the outcome in the financial services industry:

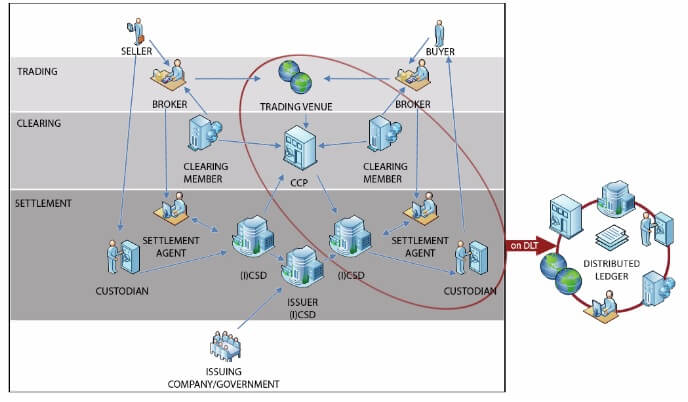

- The incumbent institutions embrace the new technology to improve cluster/internal efficiency, leaving business practice “as it is”, i.e. current business practice continues

Savings in reconciliation costs are estimated at $1.2 billion for 2016, with the only breakthrough being near real-time updating of any change in ownership of the security due to direct access to the same ledger by intermediaries.

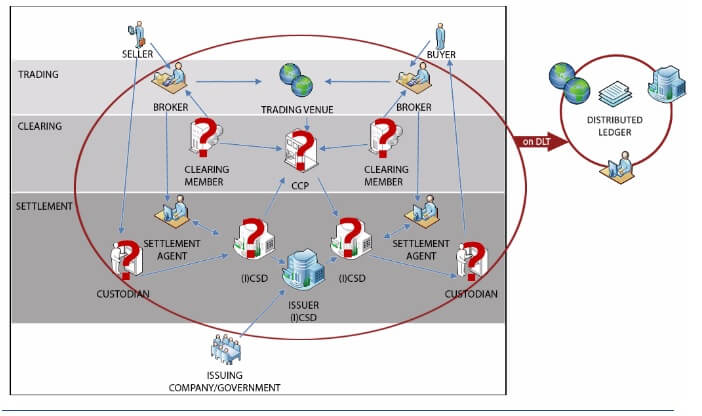

- Core players, such as CSDs, adopt market-wide distributed ledgers. In this “adoption model” scenario, at least some peripheral players might become redundant.

A market-wide distributed ledger would mean automatic updates of securities accounts and some layers of the industry could become redundant, potentially ousting clearing houses, custodians, central securities depositaries (CSD) and the central counterparty (CCP).

More transparency in securities executed over the counter (OTC) would be a major achievement as well, with regulators having access to the ledger.

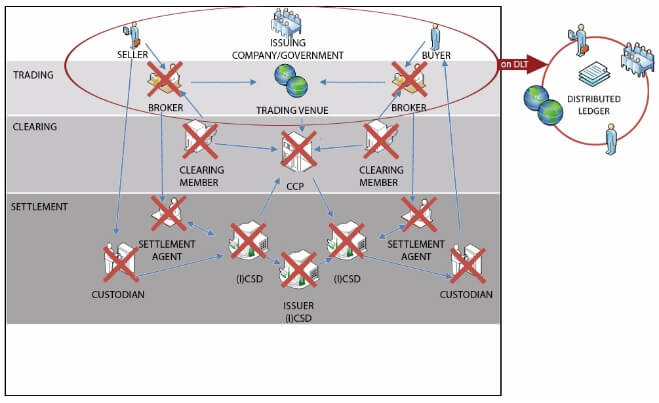

- Issuing companies, governments or fintech companies take the lead in implementing peer -to-peer systems for securities transactions, thus taking the post-trade industry into a “new world”.

If capital markets were to migrate to a peer-to-peer model, the whole chain of intermediaries would become redundant. Companies and governments would have direct access to the market and issue their own securities on the distributed ledger.

The ECB working paper argues since current validation technologies do not protect privacy, sophisticated investors could find unfair advantage against their unsophisticated counterparts by checking information such as liquidity needs. However, technical solutions using zero-knowledge proof algorithms are under development.

“Distributed ledger technologies are of relevance beyond the Bitcoin and its unrestricted blockchain model. Consensus ledgers, restricted technologies and smart contracts all represent more viable and attractive options for financial institutions, as they draw on existing business models used in the post-trade industry for securities transactions and have the potential to create safer, more reliable and efficient post-trade processes”, says the paper authored by Andrea Pinna and Wiebe Ruttenberg, that concluded that there is potential in distributed ledger technology and welcome innovations that bring safety and efficiency.

“A number of factors could, however, pose potential barriers to the widespread uptake and use of DLTs. First, the technology is not yet mature; second, the clarification of critical legal, operational and governance issues will take time; and third, even were DLTs to be adopted widely, certain post-trade functions will continue to be performed by institutions.”

“It is not yet, therefore, clear whether DLTs will cause a major revolution in mainstream financial markets or whether their use will remain limited to particular niches. It is possible that a DLT may find its way into the mainstream market, but should this happen, it is more likely to cause a gradual change in processes, rather than a revolution in the market”, concludes the paper.