IG aims to start offering Bitcoin Gold trading on January 8, 2018

The cryptocurrency emerged in October as a result of a bitcoin blockchain hardfork.

Leading online trading services provider IG Group Holdings plc (LON:IGG) continues to enlarge its cryptocurrency offering, with the newest addition set to be Bitcoin Gold. According to a recent email sent to IG’s customers, the broker aims to start offering Bitcoin Gold on January 8, 2018.

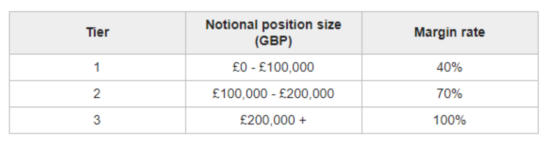

The margin rates will vary according to the notional position size, starting from 40%.

Let’s recall that this cryptocurrency emerged as a result of a bitcoin blockchain hardfork in October 2017.

IG already offers trading in Bitcoin and Ethereum, with the latter added to the lineup in August this year.

In December this year, a representative of the broker said that Ripple and Litecoin are set to join the offering soon, although the precise timing is uncertain.

“We feel we are at a point where we can add Ripple and Litecoin to the IG dealing platform. We shall be doing this shortly however I can’t give a guaranteed date as it’s dependent on a couple of other factors”.

It would be relatively easy to add a new cryptocurrency, IG’s representative explained back then , however “we need to make sure that the offering we create can work for 150,000 clients who may all overwhelmingly want to deal in one direction. There is significant due diligence which needs to be done to make sure clients can always exit their leverage positions easily and quickly, that their positions are safe, and that there aren’t any systemic risks”.

In its email concerning Bitcoin Gold, IG notes that there is a limit to the total amount of physical cryptocurrency that IG can hold as a business. This is reflected in the limiting of the exposure that each client is allowed to maintain through CFDs and spread bets. The limit is currently at GBP 250,000 notional or equivalent per client across all cryptocurrency holdings. Any clients with a notional size above this limit is at risk of having their cryptocurrency position reduced.