IG enables traders to add % Range to watchlists on web trading platform

A new function – % Range, is a measure of volatility that enables traders to sort the markets in their watchlists by price range movement.

Online trading major IG Group Holdings plc (LON:IGG) continues to enhance its web trading platform, with the newest function added to the web trading platform being % Range.

Put simply, % Range is the difference between the high and low quotes of the session divided by the current mid price:

% Range= (High price – Low price) / Mid price

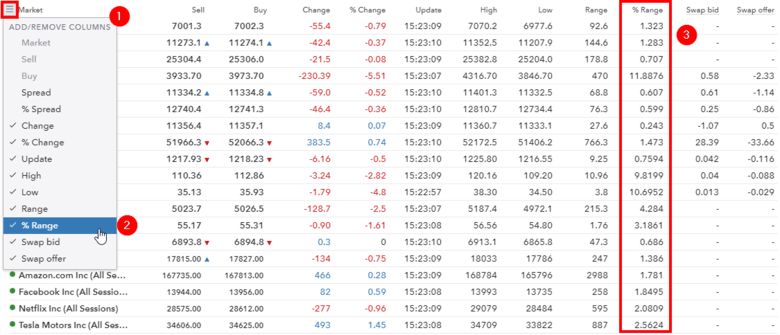

This is a measure of volatility that allows traders to sort the markets in their watchlists by price range movement. To add this functionality to a watchlist, traders have to click on the three lines that are positioned on the top left-hand corner next to the word ‘Market’, where a drop down menu will appear. Then they have to click on the % Range buttons to activate it.

This indicator shows the price range a product has had during the trading session. By dividing the range (the difference between the high and the low prices) by the mid-price (the current market value of an asset) the value indicates how much the range of the trading session is over the mid-price, as a percentage. The higher the figure, the higher the volatility during the trading session, and potentially a greater opportunity to take advantage of price movements.

If the price has seen little movement, the highs and lows will be close together, meaning that the difference between the two will be small and will represent only a small percentage of the mid-price. If, on the contrary, the range for the trading session is very wide, the value will represent a higher percentage of the mid-price, therefore indicating that there has been higher volatility.

The indicator % Range is said to have a number of advantages over % Change and Range. For example, % Change shows the current difference in price as a percentage over the closing price of the previous day. It is a good measure to understand where the current price stands in regard to where it closed in the previous session. But in case a certain asset experienced high volatility during the session but then came back to where it closed the previous day, it will not give any insight of the volatility it has experienced.

Range is seen as a good measure of volatility, but the amount of points between the high and low price can be more or less significant depending on the price of the product. % Range overcomes this as it factors in the price of an asset by brining its mid-price into the equation. The lower the mid price, the more significant price movements will be.

Speaking of recent improvements to IG’s web trading platform, let’s recall that in October this year, IG introduced a new options trading interface on the HTML5 trading platform.