IG Group performs U-turn: Company asks “why pay for something you don’t use” yet upholds inactive account charges

This morning, IG Group published an advert asking customers “Why pay for something you don’t use” relating to stop loss charges, however the company levied an account inactivity charge of £12 two years ago which remains in force – an inactive account being something “you don’t use”

Among Britain’s vast electronic trading giants, it appears that some are more equal than others.

IG Group, one of the largest electronic trading firms in the world with a market capitalization of £3.14 billion has a very distinct place in the market, and is a prominent firm among London’s long-established stalwarts.

The company’s marketing strategy today has taken an interesting course indeed.

Today, IG Group has posted on its Facebook feed a type of advertisement that infers that traders should consider what they are paying for.

“Why pay for something you don’t use?” says the advertisement. “Our unique guaranteed stop loss comes with no charge unless your stop is hit.”

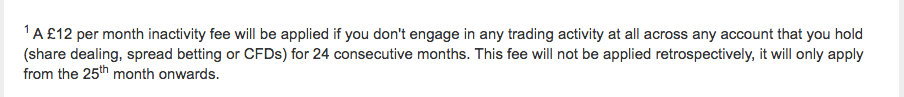

Whilst this may appear attractive to retail traders, it is worth bearing in mind the account inactivity fees that IG Group began levying a couple of years ago, by which clients pay handsomely for something that they don’t use.

Advertising with regard to charges is most certainly a very significant method of attracting customers, however making a statement to this effect is worthy of further research as there may be other areas in which a firm charges for something that a customer may not use.

Here is an excerpt from IG Group’s notification of charging customers for inactivity:

“No comment” came the reply

FinanceFeeds contacted IG Group’s marketing department today in order to gain clarification on this matter, however the company responded by stating “no comment.”

The incisive method by which IG Group solicits its customers and ensures that it can maintain an edge over the very sophisticated and equally strong competition has come to light a few times recently, a good example being the restriction in trading that blighted $1 billion dollar firm Plus500 last year.

According to a number of sources at the time, Plus500 UK’s restriction was initiated by a series of competing companies having close relationships with FCA officials, and in some cases recruiting former FCA officials to work in departments dedicated to researching what could be deemed as malpractice by competitors in order that they can use their channels and connections to converse with officials in order to put a metaphorical spanner in their works.

The basis for the FCA’s instruction to Plus500 UK was that the regulator had concerns about the company’s checks when onboarding new clients, especially relating to Anti-Money Laundering (AML) procedures.

By mid-June 2015, following this action, Plus500’s valuation had declined to £459.6 million, almost half of the firm’s value just two weeks prior, rousing the interest of Teddy Sagi’s Playtech PLC (LON:PTEC) which entered into discussions with Plus500 with regard to acquisition, and thus today yet again the regulator has stepped in to halt proceedings.

This matter was quickly put to bed, and Plus500 once again is flourishing with its market capitalization back at high levels, resting at £854 million which is way past the $1 billion that it stood at prior to the regulatory freeze.

Photograph copyright FinanceFeeds