IG Group marks 6% decline in net revenues in H1 FY19, in line with forecasts

Whereas ESMA’s product intervention measures weighed on IG’s financial performance in Europe, the broker is successfully expanding in the United States.

Online trading major IG Group Holdings plc (LON:IGG) has earlier today posted its results for the six-month period to end-November 2018.

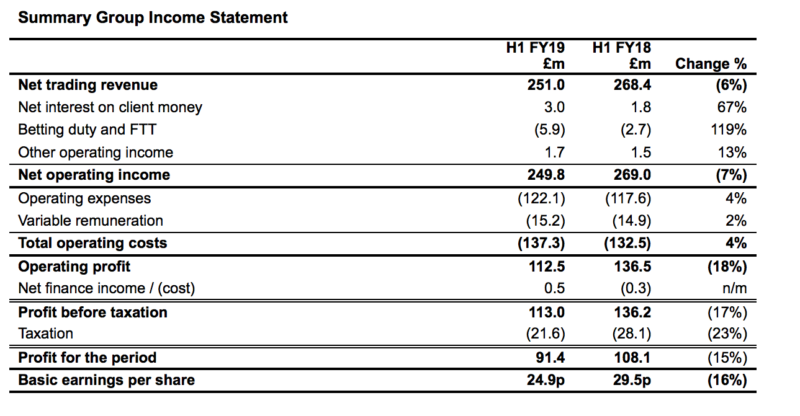

In tune with forecasts, IG recorded a 6% year-on-year drop in net trading revenues in H1 FY19. Net trading revenue was £251 million in the period, compared to £268.4 million in H1 FY18. The drop was blamed on ESMA’s product intervention measures.

Operating costs excluding variable remuneration were £122.1 million, 4% higher than in the prior year, operating profit in the first half of the year was £112.5 million, 18% lower than in the prior year, with the operating profit margin at 44.8%.

In the second quarter of the year (Q2 FY19), when the ESMA measures were in effect throughout, the Group’s net trading revenue of £122.1 million was 8% lower than in the same period in the prior year. Revenue in the ESMA region in Q2 FY19 was 18% lower than in the prior year. This was offset by the 9% growth in revenue from the Group’s OTC leveraged derivatives business outside ESMA. Both these figures are underlying changes, adjusting for the 1,200 clients who previously contracted with a UK entity who are now trading with an entity outside the ESMA region.

During the first half of FY19, IG Europe (IGE), the Group’s client facing subsidiary in Germany, received its licence from BaFin. This provides certainty that IG will be able to offer its regulated financial products in all EU member states following the UK’s exit from the EU. IGE is expected to launch by the end of January 2019.

IG has continued the development of its MTF, Spectrum, for the European retail market. The MTF will offer transferrable securities in the form of turbo warrants. This project is on target to go live in May 2019.

The Group’s new USA subsidiary received approval during the period to become a member of the NFA and is now registered to operate as a Retail Foreign Exchange Dealer (RFED).

The Company believes that its retail FX offer in the US will be able to compete successfully in what is currently a limited competitive market with only three other providers. IG has the added benefit of the lead generation provided by the DailyFX website. This business is expected to launch by the end of January 2019.

In terms of outlook, IG continues to expect that its revenue in FY19 will be lower than in FY18, reflecting the impact of the ESMA measures, and the exceptional performance in the second half of FY18 when revenue was boosted by the heightened level of interest in cryptocurrencies.

The broker continues to expect that its total operating costs (operating expenses plus variable remuneration) in FY19 will be at a similar level to the £290 million total operating costs in FY18.