IG Group registers growth in client numbers in H1 FY20

Net trading revenue in IG’s core markets was 6% lower in H1 FY20 than the same period in the prior year due to a 13% reduction in revenue in the ESMA region.

Online trading major IG Group Holdings plc (LON:IGG) has just posted its key financial results for the first half of fiscal year 2020, that is the six months to end-November 2019.

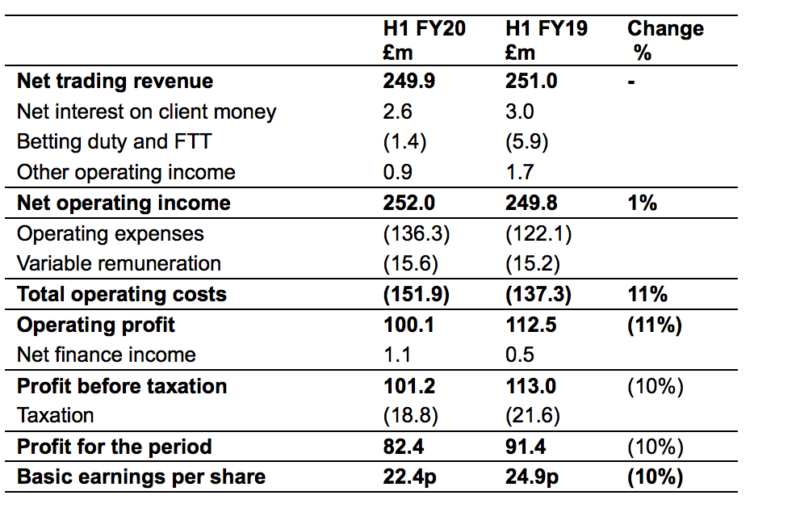

The Group’s net trading revenue in H1 FY20 was £249.9 million, compared with £251.0 million in H1 FY19. This is in tune with forecasts. The brokerage also notes that the first half of the prior year benefitted from two months of trading prior to the ESMA product intervention measures coming into effect.

Net trading revenue in IG’s core markets was 6% lower in H1 FY20 than the same period in the prior year. This was due to a 13% reduction in revenue in the ESMA region which was impacted by the introduction of the ESMA product intervention measures, and the lower level of trading by professional clients in the second quarter FY20 compared with a strong year-ago period.

Operating profit in the period was £100.1 million, 11% lower than a year earlier. After net finance income of £1.1 million, profit before taxation was £101.2 million. The effective tax rate applied to the profit before tax for the period is 18.6% (H1 FY19: 19.1%) with profit after tax of £82.4 million.

Basic earnings per share of 22.4 pence is 10% lower than in the first half of FY19.

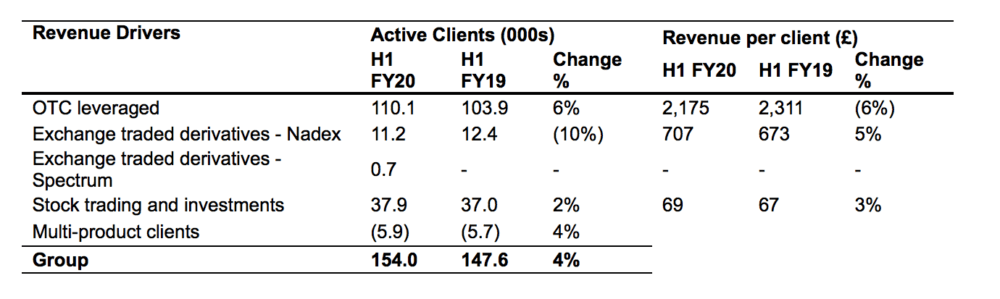

During H1 FY20, IG generated 96% of its net trading revenue from OTC leveraged derivatives. OTC leveraged revenue in the half was £239.5 million, in line with H1 FY19. IG served 6% more active clients in H1 FY20 which was offset by a 6% reduction in revenue per client.

ESMA region OTC leveraged active client numbers were up 4%, whereas other Core Markets OTC leveraged active client numbers grew 5%.

To drive greater synergy, the Group’s US businesses are now managed as a single business unit. IG US, the OTC FX business, has steadily increased the number of active clients it serves, and will continue to focus on building its brand by increasing the awareness of IG’s low commissions, speed of execution and quality of customer service compared with the competition. IG US benefits from the lead generation provided by DailyFX, which receives around 2 million unique visitors a month.

Client acquisition for the US Exchange Traded Derivatives business, Nadex, has been more challenging in the period, and the business continues to refine its product proposition and target audience. You can get more details about the recent changes concerning IG’s US business from this detailed report.

The marketing launch of the Group’s MTF, Spectrum, took place in October. Spectrum represents a further diversification of the Group’s product range, offering European Retail clients the opportunity to trade securitised derivatives in the form of turbo warrants. Spectrum has successfully launched with turbo24s on equity indices, currencies and commodities and the plan is to expand its product set to include single name equities. Client interest has been positive, with around 700 active clients from launch to the end of the period. 33% of trades are made outside of normal market hours.

IG has recruited a new Head of Greater China, who is responsible for building the Group’s presence in this region, and for identifying and delivering routes to market that will provide clients with access to IG’s proprietary technology, broad product capability and market leading execution.

In terms of outlook, in line with previous guidance, IG expects to return to revenue growth in FY20. The brokerage forecasts that total operating expenses, excluding variable remuneration will be around £30 million higher than FY19 and that it will maintain the 43.2 pence per share annual dividend until its earnings allow it to resume progressive dividends.