IG Group’s Chief Financial Officer and Chief Strategy Officer buy company shares

The transactions have been done under IG’s Share Incentive Plan.

Online trading major IG Group Holdings plc (LON:IGG) has reported recent transactions in its shares by its management.

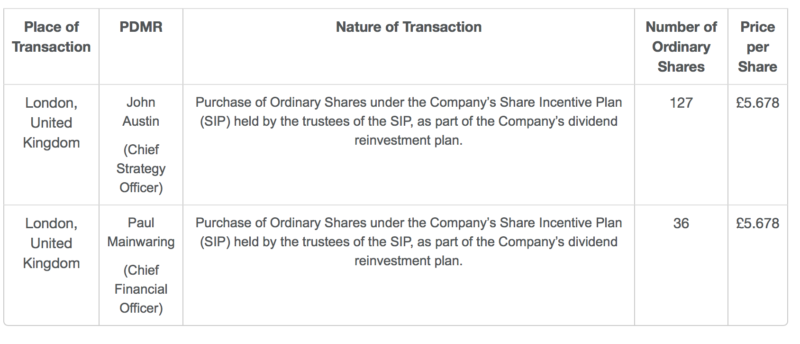

IG was notified on March 7, 2019 of transactions carried out in respect of the company’s ordinary shares of 0.005p each by Persons Discharging Managerial Responsibilities (PDMRs). On March 5, 2019, IG’s Chief Strategy Officer John Austin and IG’s Chief Financial Officer Paul Mainwaring bought shares in the broker.

The purchase of ordinary shares was done under IG’s Share Incentive Plan (SIP) held by the trustees of the SIP, as part of the Company’s dividend reinvestment plan. John Austin acquired 127 shares, whereas Paul Mainwaring bought 36 shares.

On January 23, 2019, IG Group’s Chief Executive Officer June Felix bought 17,000 ordinary shares of 0.005p each. The price of each share was £5.858, which results in an aggregated price of £99,579.38. This was not the first time that June Felix bought IG shares following her appointment as Group CEO. On October 30, 2018, she also bought 17,000 shares in IG Group.

IG has seen some exciting business developments lately. On February 27, 2019, the broker announced the launch of IG US, its US-based subsidiary offering foreign exchange trading. IG US clients can trade over 80 currency pairs, with competitive spreads. The IG platform integrates news feeds and live TV with real time charts built with HTML5 technology. IG also offers its own native mobile apps for iOS and Android devices and supports MT4.