IG reduces minimum deal sizes for UK spread betting accounts and European CFD accounts

The minimum bet sizes have been lowered on some key indices, commodities, and FX markets.

Online trading major IG Group Holdings plc (LON:IGG) has recently changed the trading conditions for UK spread betting accounts and European CFD accounts.

The broker has informed its clients that it has recently reduced the minimum bet sizes on some key indices, commodities, and FX markets.

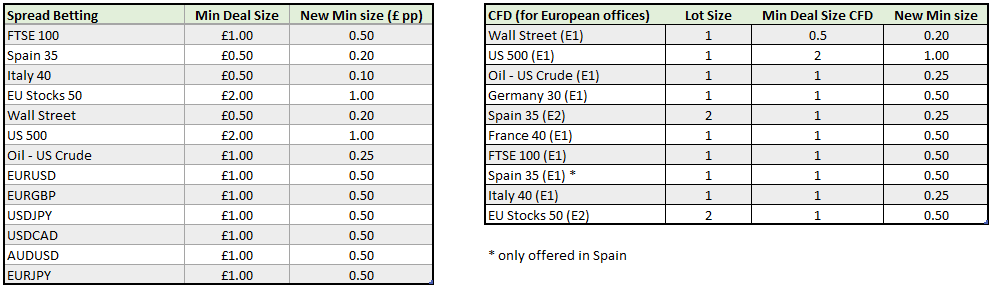

For owners of UK spread betting accounts, the change will translate into lower minimum bet sizes for several indices, such as FTSE 100 and EU Stocks 50. These traders will also see reduced deal sizes for US Crude, as well as for six currency pairs, including EUR/USD and EUR/GBP.

Owners of European CFD accounts may benefit from reduced minimum deal sizes on 10 indices such as Wall Street (E1) and France 40.

The conditions are correct as of September 6, 2018, but may change in the future.

The change is likely to be appreciated by those traders who need to enter the trading field more gradually. One of the consequences of reduced minimum deal sizes is the lower risk. This is in line with efforts by IG Group to secure enhanced protection for retail investors.

Let’s recall that the new ESMA rules for CFD offering to retail clients came into effect on August 1, 2018. In a recent update, IG said it believes that enforcing consistent close-out procedures, putting a negative balance protection per account, restricting trading incentives such as bonus offers, and issuing standardised risk warnings would all improve client outcomes.

Regarding the status of its clients, IG noted that clients who were categorised as professional on June 30, 2018, generated over 40% of the Company’s UK and EU revenue in the preceding three months, and the Group continues to expect this proportion to rise to 50%.