IG US LLC gets official registration as Forex Firm and Retail Foreign Exchange Dealer

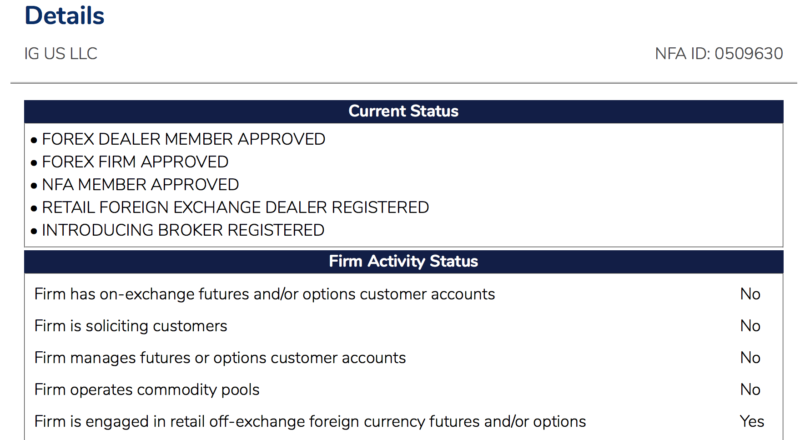

The National Futures Association database shows IG US LLC is now registered as Retail Foreign Exchange Dealer (RFED), and Introducing Broker.

In line with previous reports by FinanceFeeds about plans by IG Group to reestablish itself in the North American retail FX market, the online trading major has obtained the necessary regulatory registrations in the United States. The BASIC system of the National Futures Association (NFA) shows IG US LLC has secured a number of approvals, dated October 15, 2018.

IG US LLC has just gotten officially registered as Retail Foreign Exchange Dealer (RFED), and Introducing Broker. It has been approved as Forex Dealer Member, Forex Firm and NFA Member.

The business address of the company is:

200 W JACKSON BLVD

SUITE 1450

CHICAGO, IL 60606

UNITED STATES

(312) 981-0500

The list of principals shows Rupert Simon Toby Osborne as Chief Executive Officer, and Ronald Lee Wetzel as Chief Financial Officer. Karen Alicia Degroot is listed as Chief Compliance Officer.

The firm is engaged in retail off-exchange foreign currency futures and/or options.

IG Group has reiterated its interest in the US OTC FX market, where it believes the market is currently underserved. IG filed its licence application at the end of November 2017 to establish a new subsidiary based in Chicago. In July this year, IG said it had completed hiring for key roles. The Company said back then it expected to launch this business in the first half of FY19.

There are just a handful of retail FX brokers currently offering their services in the US retail FX market – GAIN Capital and OANDA are some examples. The exit of FXCM from the US due to the regulatory action against the company in early 2017 and the settlements with the regulators have significantly changed the retail Forex landscape in the US, making it attractive for new market participants. It is possible that we’ll see more industry participants enter the retail FX market segment in the US.