Increased volatility fuels IG Group’s revenue growth in FY20

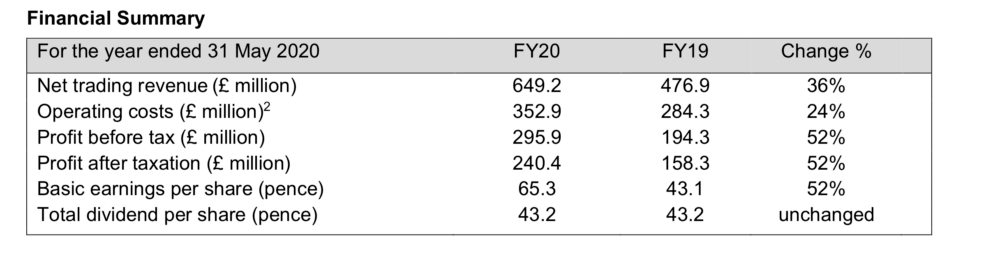

Net trading revenue was £649.2 million, 36% higher than the prior year.

Electronic trading major IG Group Holdings plc (LON:IGG) today announced its results for the twelve months ended May 31, 2020 (“FY20”).

In FY20, IG delivered record revenues and profits, with growth across all regions and products. It also built momentum and achieved significant progress towards its medium-term financial targets and the broader diversification of the business.

Net trading revenue was £649.2 million, 36% higher than the prior year. This performance was underpinned by good growth in the first three quarters of the financial year, prior to the heightened market volatility in the fourth quarter of FY20. In the first three quarters, net trading revenue of £389.7 million was up 9% on the prior year period (Q1-Q3 FY19: £359.0 million).

In Q4, net trading revenue accelerated to £259.5 million. This reflected the unprecedented level of client trading activity from the sustained period of volatility across global financial markets triggered by the Covid-19 pandemic and other macro events.

In total, IG Group recruited 96,900 new clients in FY20, up over 100% on the prior year. The Group also continues to benefit from the loyalty and tenure of its established client base, with 55% of revenue in the financial year generated from clients who have traded with IG for more than three years. In the final quarter of the financial year IG onboarded 51,200 new clients across its product offering with 35,300 new OTC Leveraged clients placing a first trade in the period.

Total operating expenses, excluding variable remuneration, were £308.6 million,19% higher than the prior year (FY19: £259.6 million). This included investments of £35 million in prospect acquisition and development of the IG brand, and the launch of IG’s new businesses in the US and Europe.

Profit before tax increased to £295.9 million (FY19: £194.3 million) with an operating profit margin of 45.6%. Conversion of operating profit into cash was strong, with own funds generated from operations of £345.0 million (FY19: £198.1 million).

During the final quarter of 2020, record levels of client onboarding saw 35,300 new OTC Leveraged clients, 17,900 new stock trading clients and 3,200 new on-exchange clients placing a first trade in the period. New clients onboarded in Q4 FY20 generated 14% of the total OTC Leveraged revenue in the quarter.

Further improvements in the Group’s digital marketing capability are targeted for FY21, with additional investment in IG’s brand following the new brand launch in June 2020, and an expansion in digital solutions to drive cost efficiency and improve scalability.

IG noted the return to growth in FY20 in the ESMA region Retail client base following a significant regulatory shift in FY19. In the ESMA region, revenue increased 26% to £328.5 million year on year, accompanied by growth in the number of active clients and a small increase in the revenue per client.

In addition, during the period the Group successfully implemented new regulations in Singapore, an important Asian regional market for IG.

As previously indicated, further changes are possible in FY21 in some markets in which IG operates, including Australia. The Australian Securities and Investments Commission has not yet confirmed its final proposals or timelines to implement new regulations for leveraged OTC products, although this is expected within the next financial year.

The Board recommends a final dividend of 30.24 pence per share, taking the full year dividend for FY20 to 43.2 pence per share (FY19: 43.2 pence), in line with previous guidance. The final dividend, if approved by shareholders, will be paid on 22 October 2020 to those members on the register at the close of business on 25 September 2020.