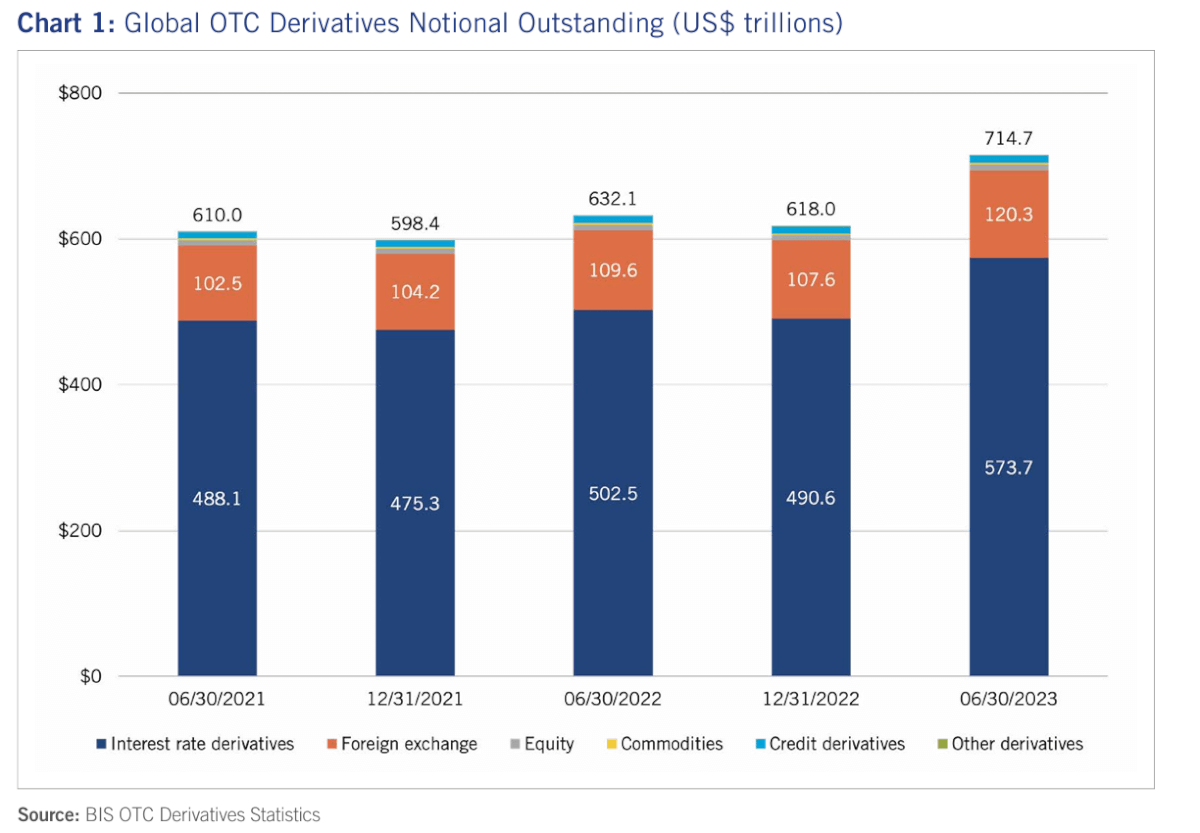

Infographic: Interest rate and FX derivatives are driving rise of OTC derivatives market

These trends suggest a growing and evolving OTC derivatives market, with an increased focus on risk management and regulatory compliance. The rise in clearing rates, along with the increased initial margin requirements, reflects a more cautious approach to risk in the financial services industry.

ISDA has released a report backed by data released by the Bank for International Settlements (BIS), which showed significant trends in the over-the-counter (OTC) derivatives market for the first half of 2023.

There has been a notable increase in the notional outstanding, gross market value, and gross credit exposure of OTC derivatives during this period, compared to the first half of 2022. The rise is attributed to the growth in interest rate and foreign exchange (FX) derivatives, driven by increasing interest rates for major currencies.

Rise of OTC derivatives

Growth in Notional Outstanding: The global OTC derivatives notional outstanding experienced a 13.1% increase by mid-year 2023 compared to the same period in 2022.

Rise in Gross Market Value: The gross market value of OTC derivatives saw an 8.1% rise over the same period.

Increase in Gross Credit Exposure: The gross credit exposure, which is the gross market value after netting, grew by 10.5%.

Impact of Close-Out Netting: Total mark-to-market exposure was significantly reduced by 81.6% due to close-out netting, which is a method used to reduce risk in financial contracts by aggregating multiple obligations.

Collateral and Credit Exposure Reduction: Credit exposure was further mitigated through collateral posted for both cleared and non-cleared transactions.

Higher Clearing Rates: Clearing rates for interest rate derivatives (IRD) and credit default swaps (CDS) saw an increase. This reflects a continuing trend towards central clearing in these markets.

Initial Margin Postings: At mid-year 2023, firms posted $389.0 billion of initial margin (IM) for cleared IRD and CDS transactions at major central counterparties (CCPs), up from $359.7 billion a year earlier. This rise indicates heightened risk management practices among market participants.

These trends suggest a growing and evolving OTC derivatives market, with an increased focus on risk management and regulatory compliance. The rise in clearing rates, along with the increased initial margin requirements, reflects a more cautious approach to risk in the financial services industry.