Institutional career in London and suburban lifestyle without the headache? Impossible surely?.. Hello Elizabeth!

Less than a year’s salary as an interbank or institutional trader in London will buy a fantastic mortgage-free lifestyle in the home counties, and thanks to the advent of the Elizabeth Line, the sole downside – that awful commute – will be no longer a consideration. We take a mildly amusing look at what this all means

Fancy this house for less than half a year’s salary? Elizabeth could make that happen

2017 is now upon us, and London’s gigantic, highly productive economic powerhouse that is the interbank, institutional and large scale retail FX industry that dominates the entire world is about to head back to the office en masse following the holidays.

For many of London’s astute and sophisticated industry leaders, the City is home, and has been throughout the duration of their illustrious and forward-thinking careers, however the potential to have a very different lifestyle is on its way, without the associated downside of that ghastly commute by standard train.

GWR is supposed to stand for Great Western Railways, however it may as well stand for Going Wrong Regularly, plus any aspirations of the Home Counties serenity of living in leafy Berkshire or rural Oxfordshire are often quashed by the bleak and heart-sinking reality of having to set foot every morning on a crowded 30-year old InterCity 125 train which costs a fortune, takes forever and arrives at Paddington, which, lets face it, is the wrong end of Central London.

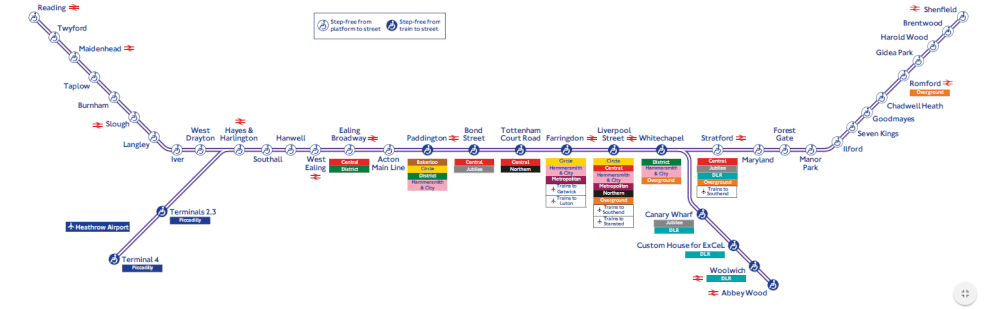

As 2017 gets underway, Transport for London’s completion of the Elizabeth Line, which is the new line that runs from Reading to Shenfield, which is effectively east to west, 40 miles outside London’s square mile on either side, gets closer, with its final stages due to be ready in 2019.

For much cheaper than the inter-city trains, and, if Transport for London are to be believed, much shorter journey times, London’s finest industry talent could be in Liverpool Street just 35 minutes after having walked the dogs and fed the horses in the Hunter-wellies and Barbour Jacketed surroundings of the Chiltern Hills.

In August 2016, a once taboo subject had begun to become less taboo, as the cap on the bonuses awarded to traders at Tier 1 banks had begun to be lifted, the rationale for its introduction having been as part of an attempt to diminish awards for risky trading behavior post financial crisis.

Whilst the ideology may have been sound enough, the reality of the imposition of such a cap on bonuses has, as with most anti-business legislation, been more damaging than useful.

The rules imposed by the European Commission are that bonuses must be limited to double the fixed salary for what are considered to be risk takers, as well as those earning more than the equivalent of 500,000 Euros per year.

One of the downfalls of anti-free market legislation is that it creates an environment in which businesses are restricted, and talent moves on elsewhere in order to fulfill their potential without being shackled by legislation.

One particular bank, BBVA, expressed concern late last year that a bonus cap of this nature is preventing the company from hiring good quality and highly experienced executives from the technology sector, as well as preventing it from acquiring financial technology startups which specialize in moving the banking sector forward.

This means potentially huge salaries once again, and a true meritocracy.

If living in Central London, the cost of owning an apartment is now astronomical, thus even if bonuses are high, the cost of living is, believe it or not, in line with a relatively middle-class lifestyle even for very highly remunerated professional interbank traders.

Certainly it was possible to make a £1 million annual remuneration in pre-stock market crash London. Before Black Monday, October 19, 1987, when stock markets around the world crashed, shedding a huge value in a very short time. The crash began in Hong Kong and spread west to Europe, hitting the United States after other markets had already declined by a significant margin, it was possible to rise from teenage pennilessness to extreme wealth within just one year in London.

The bleak 1990s passed, and the global towers of strength rebuilt their vast institutions.

In 2010, in New York, a first-year trader generally earned an annual base of slightly more than $64,000 with a bonus that brought total compensation to approximately $85,000.

Commodity and currency traders median wages, according to the U.S. Bureau of Labor Statistics’ 2010 survey, were $60,980 per year with a median yearly salary of $104,000 earned by the top 10%.

Firm profitability and trading volume still today makes a big difference to bonuses. Experienced traders at a major trading house can make base salaries of approximately $100,000 to $120,000, with bonuses bringing them to $150,000 to $250,000 or higher in total compensation.

Today, those figures are still quite similar for young traders, however those at directorship level, or heading specific sales teams within banks that concentrate on certain asset classes whether FX majors or other spot derivatives, are able to earn more than $600,000.

In London, the salaries are even higher.

A testimony to the technologically advanced nature of today’s institutional financial structure is that compliance officers in London are now in such demand, due to the need for not only the regulatory requirements to be fully understood by such professionals, but because of the highly sophisticated reporting systems that companies are using, and the high-tech approach now being taken by regulators, that day rates of up to £1200 are not uncommon for medium-level compliance officers.

That is more than some traders.

In 2015, Managing Directors in London (most institutions have several Managing Directors, each responsible for their specific channel of business within the institution – this is not a CEO position and sometimes is not a board position – it is a senior level manager of a specific department) earned an average of $898,000.

That translates to £677,000 and by all accounts is substantial remuneration for a demographic that is in the 30 to 50 year old age range and still has some levels of the corporate ladder to climb. The previous year, the same level of staff received an average of only £250,000.

Interestingly, traders at some of the large institutions, including Bank of America Corporation’s London office and Citigoup’s Canary Wharf headquarters displayed considerable discourse to their employers with regard to their bonus amounts in 2015.

45% of Bank of America’s front-office traders expressed dissatisfaction with their bonus, and 42% of Credit Suisse staff were also vocal about their lack of gratitude for their bonus, despite Credit Suisse having made huge losses last year – indeed the bank’s first loss for 8 years.

In 2016, bonuses tend to fluctuate across each trading desk, depending on the focus of the bank with regard to risk and wishing to drive certain products forward over others as well as paying traders more for dealing with more complex financial instruments.

This year, traders receive bonuses ranging from 40% (for repo traders) to 113% of their annual salary for flow rates traders.

This year, a trader in a non-directorship position, with no board membership and who works on a city desk is likely to earn an average of £221,000 in London.

Working as a non-senior executive at an institutional non-bank firm this year will usually result in a salary of between £100,000 and £150,000 for those who are skilled at maintaining strong relationships with Tier 1 banks and with liquidity takers.

Yes, the cost of living has increased tenfold since the days during which power dressing was en vogue and the Human League and Kraftwerk graced the 8-track players in the array of Jaguar XJ-S V12s driven by young men with ambition, however the actual remuneration of today is roughly the same as it was 30 years ago, and in the same vein, the financial centers of New York and London continue to have very much their own economies.

The other thing that has changed since those days is that London has rocketed in terms of property prices, a small apartment in Hackney today will cost at least £500,000 today, for example, and a family home in Golders Green would be upwards of £3 million in many cases, whereas the provinces have not risen in price to anything like that extent.

This means that a London executive can afford a very substantial home 40 miles east or west of the Square Mile, and now be in Liverpool Street within just half an hour, thanks to the Elizabeth Line.

By the time the land has been bought and the mansion built, the Elizabeth Line’s brand new Derby-assembled Bombardier rolling stock will be ready to, well, roll.

Here are some examples of how less than a year’s salary in many cases could buy a very pleasant home on the direct route that the new Elizabeth Line will follow.

Me? I like London too much….