Interactive Brokers adds enhanced Quote Details window to TWS platform

The window provides more data, including Comparison to Historical, Comparison to Peers and Scanner Results.

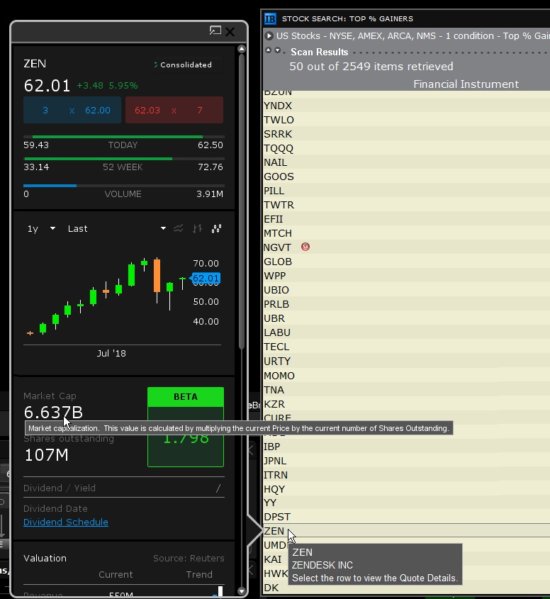

Electronic trading major Interactive Brokers Group, Inc. (IEX:IBKR) keeps improving the functionalities of its TWS platform. The company has introduced an enhanced Quote Details window in the latest (beta) version of the platform.

The enhanced Quote Details window has:

- More data, including Comparison to Historical, Comparison to Peers and Scanner Results;

- Provides a more vibrant, graphical display that’s easy to read;

- Is context-sensitive to show instrument-relevant data. It will display different information for ETFs than it will for stocks or for bonds.

On top of that, the enhanced Quote Details summarize key data from different TWS tools, then provide a link from that data to launch the relevant tool. For instance, trader can view an option and then see aggregated Performance Profile data with a link to launch the Probability Lab. Or, they can view an ETF or Mutual Fund, and see similar ETFs with potentially lower fees, with a link to launch the Mutual Fund/ETF Replicator.

To display the Enhanced Quote Details, click More Details from the Quote Details window, or open the Advanced Market or Bond Scanner and select a scan result. Turn off Enhanced Quote Details from the Quote Details page in Global Configuration.

The latest (beta) version of TWS offers a raft of other improvements too. The list includes new Pivot Point studies and more period selections available in charts. This version of the platform also enables increasing trading speed by creating custom Market Depth Trader order buttons. These buttons are available for all instruments, for a specific asset type, or even for a specific instrument.