Rakuten launches redesigned API marketplace

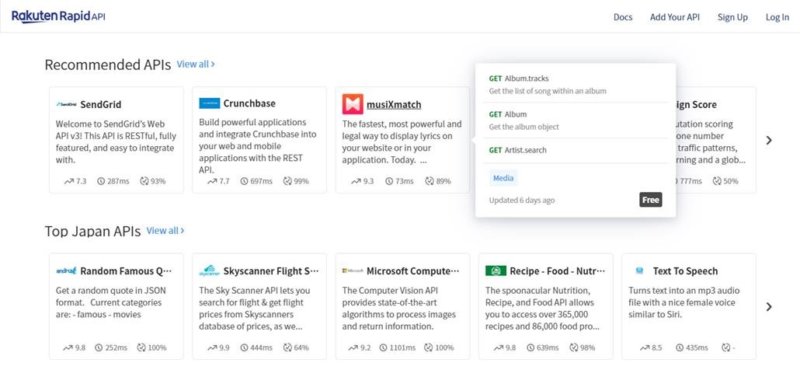

The main discovery interface has been completely redesigned and APIs are now organized by function and use case.

Less than six months after the launch of Rakuten RapidAPI, Japan’s online services provider Rakuten Inc (TYO:4755) announces the launch of “Rakuten RapidAPI 2.0” – completely redesigned API marketplace aimed at accelerating the way software developers access APIs in Japan and the Asia Pacific region.

Rakuten RapidAPI started operating in July 2018 through a strategic partnership with RapidAPI. Rakuten RapidAPI offers access to a lineup of more than 8,000 APIs used by over 500,000 developers around the world. The redesigned marketplace features a new and rich user interface (UI) developed based on user feedback.

Rakuten RapidAPI 2.0’s new UI helps developers more quickly find useful APIs on the main discovery interface through “API Collections”, a feature that groups APIs by functionality or use case. Each API will now show granular performance data including its popularity score, latency and uptime that will help developers choose the best API for their requirements. Developers will also be able, where provided, to view code samples without having to configure API calls.

Through the launch of Rakuten RapidAPI 2.0, Rakuten continues to drive the expansion of the API economy and encourage innovation among developers.

The redesigned Rakuten RapidAPI 2.0 includes features such as:

1.API Collections – Developers can more easily access all their API options for their use case or a specific function through API Collections.

2.API performance data – Each API will show three performance metrics: user rating, latency in the last 30 days, and uptime during the same period. This data visibility is one-of-a-kind and helps developers to identify APIs that meet their performance standards.

3.Greater information visibility with less navigation – On the main discovery interface, APIs will have a pop-over feature that provides additional information such as top endpoints, category, pricing model and date of last update when a cursor is placed over the API. In addition, where provided, API pages will show sample code responses without having to configure an API call.