Interactive Brokers adds Learn section in TWS platform

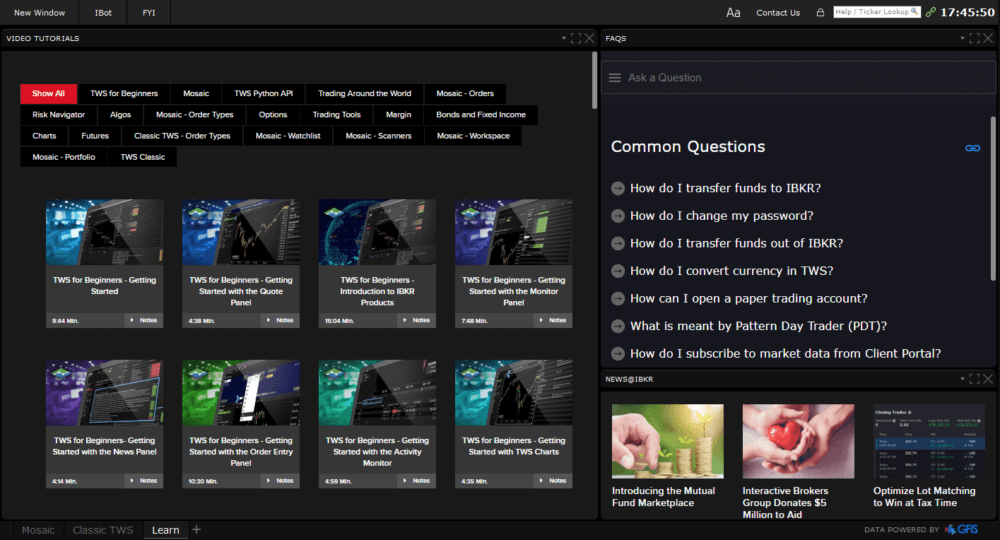

Now traders can watch video tutorials, browse Interactive Brokers’ most-requested FAQs, and keep abreast of the latest news about the company without leaving TWS.

Online trading major Interactive Brokers continues to beef up the functionalities of its TWS platform.

The latest (beta) release of the platform introduces the Learn Tab. Now, TWS users can watch video tutorials, browse some of Interactive Brokers’ most-requested FAQs, and keep abreast of the latest News@IBKR all without leaving TWS. The new Learn tab showcases all of the latest and all of the greatest features that TWS and IBKR have to offer.

Traders are invited to check back often to see what’s new and to find out more about all of the tools and products in TWS.

The Learn tab can be found in the Layout tabset along the bottom of TWS.

Let’s note that the latest beta version of the solution also introduces IB Algo Favorites preset. With the new Algorithm Favorites preset in Global Configuration, traders can now define IB Algo preset values that will populate the order parameters when they select that algo as the order type.

To set IB Algo Favorites presets, open Global Configuration (from the Mosaic File or from the Classic Edit menu) and scroll down to Presets in the left panel. Select a supported financial instrument, for example Stocks, and in the right panel scroll down to Algorithm Favorites. Select an IB Algo and define preset values. The values you define will populate the algo by default when you choose it as your order type, but you can modify any value on any order, and change preset values at any time.