Interactive Brokers adds social sentiment columns to TWS platform

Social Market Analytics’ data points are reflected in new Social Sentiment columns that can be displayed in one’s Watchlists, Scanners and Portfolio.

Electronic trading major Interactive Brokers continues to augment its fundamentals research offerings to help traders make better investment decisions. The latest provider, Social Market Analytics Inc. (SMA) delivers current (weighted) and historical social media sentiment for a company based on the content and volume of unique Tweets, which have been triple-filtered for relevance and credibility from the daily Twitter stream of over 500 million Tweets.

Current data coverage includes the entire US equity universe, over 3000 global ETFs and the LSE FTSE 1000, with content updating every 1 minute. (FX and Commodity futures and FX Spot coverage coming soon).

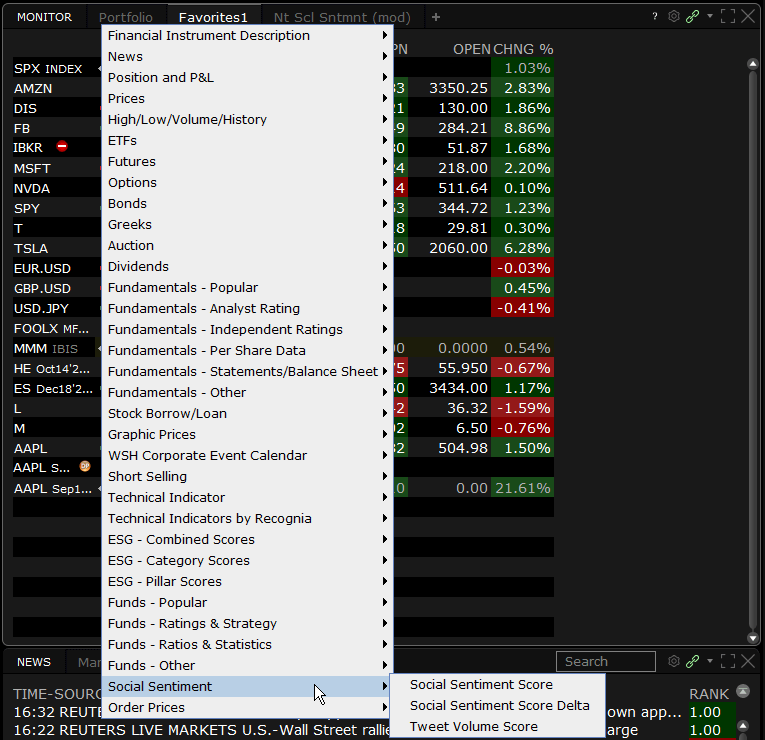

SMA data points are reflected in new Social Sentiment columns that traders can display in their Watchlists, Scanners and Portfolio.

Social Sentiment Columns include:

- Social Sentiment Score: Time-weighted summary of unique Tweets from credible accounts across a 24-hour rolling window, at the time of observation. Tweets arriving closer to the observation time carry more weight than those that arrived farther from the observation window.

- Social Sentiment Score Delta: Change in the Social Sentiment Score over a 15-minute lookback period.

- Tweet Volume Score: Indicative Tweet volume used to compute the Social Sentiment Score. Indicative Tweet volume is the number of relevent, unique tweets arriving in a 24-hour period from credible SMA-certified accounts.

To add these columns to a TWS window, hold your mouse over an existing column name until the Insert Column command appears. Click Insert Column and scroll to the Social Sentiment column group. Click a title to add the column to your window. Hold your mouse over a title in the group to see the column definition.

The latest TWS (beta) version also expands responsible investing offerings with the addition of interactive Impact Dashboard, which incorporates a new data source from TruValue Labs that scores companies against the Sustainability Account Standards Board criteria.