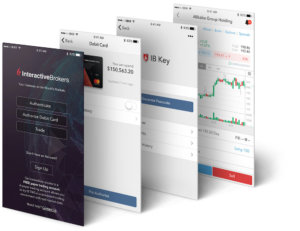

Interactive Brokers enables bond trading from mobile app

Users of the IBKR Mobile app for Android-based devices may now trade corporate and municipal bonds from within the app.

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just rolled out the latest version of the IBKR mobile app for Android-based devices. The solution now supports bond trading.

Traders can trade corporate and municipal bonds from within the IBKR Mobile app.

The latest upgrade, which apparently targets those clients of the broker who would like to diversify their range of trading instruments and investments, happens about a week after Interactive Brokers bolstered the functionalities of the mobile app related to the Interactive Brokers Debit Mastercard. As a result of the upgrade, the apps allow traders to see how much they can spend. When traders access their Interactive Brokers Debit Mastercard from IBKR Mobile, they can now view available credit where it asks “How much can I spend” by clicking Check. The value shown is the spending limit as of the time shown, e.g. “Updated 1 minute ago”, and shows the amount available for pre-authorization.

In one of the preceding updates of the apps, the broker enhanced the work with so-called “Greeks”, which help traders determine how certain factors affect the price of an option. For example, delta is a measure of an option’s sensitivity to changes in the price of the underlying asset. Theta quantifies the risk that time has on options as options are only exercisable for a certain period of time.

Users of the IBKR Mobile apps for Android and iOS devices are now able to view SPX Delta and SPX Theta for their portfolios. In the Android app, for example, traders can activate this feature from their Portfolio screen by tapping the menu (three vertical dots in the upper right corner) and checking “Show Delta & Theta.” These values display along the bottom of the dashboard of the Portfolio screen.

In March, the Interactive Brokers’ TWS platform started offering more detailed information in the Performance Profile section via an improved “Greeks” information display. The platform offers a new selector in the Scenarios blade of the Performance Profile window that lets traders choose between displaying the “Instrument Greeks” that show the traditional contract Greeks, and the “Position Greeks” calculated using (Greek value x position).