Interactive Brokers makes it easier to use Adaptive Algo

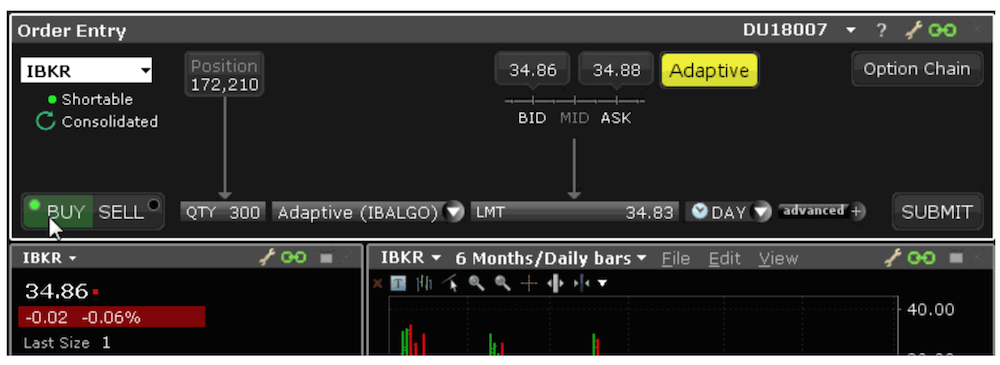

The broker has made it easier to use the Adaptive IB Algo in Mosaic’s Order Entry.

When it comes to updates to TWS, the proprietary trading platform developed by Interactive Brokers Group, Inc. (NASDAQ:IBKR), we have gotten used to seeing enhancements to the functionalities of IBot, the Artificial Intelligence solution that knows the answer to a great variety of questions a trader might have. But the platform offers many other interesting and useful tools and its latest beta version will deliver an improvement related to one such tool, the Adaptive Algo.

TWS now simplifies the use of the Adaptive IB Algo in Mosaic’s Order Entry, so that traders can easily achieve the fastest fill at the best all-in price. As the name of this algo suggests, it adjusts to match market conditions.

In order to use the Adaptive IB Algo in Mosaic’s Order Entry, one simply has to click on the Adaptive button – this will activate the Adaptive mode. Traders then may choose to set a specific limit price, which results in an Adaptive Limit order, or leave the “MARKET” price, which leads to an Adaptive Market order.

An Adaptive Market order dynamically selects and varies the price in order to fill at the best all-in price. An Adaptive Limit order uses the limit price as a price cap. The Adaptive Limit will only fill at the specified limit price or better.

The Adaptive Algo order type draws on IB’s Smartrouting capabilities along with user-defined priority settings in order to deliver further cost efficiency at the point of execution.

This algo can be used with a limit or market order and aims to ensure that market and aggressive limit orders trade between the spread. Traders can define how urgently they want an order to fill by using the “priority/urgency” selector in the algo window. This algo order type may be particularly helpful for an investor when the spread is wide.

There are other settings too. The “critical” setting scans for a brief period of time, whereas the “patient” scan works more slowly and has a higher chance of achieving a better overall fill for one’s order.