Interactive Brokers overhauls AI tech that powers IBot

The broker plans a series of improvements with the first concerning the user interface that will allow easier application of machine learning.

IBot, the artificial intelligence solution developed by Interactive Brokers Group, Inc (NASDAQ:IBKR), is facing a major overhaul.

The electronic trading expert said it was making drastic changes to the AI technology for IBot, with the first step in a set of improvements to revamp IBot’s user interface. This change is set to make it easier to apply machine learning, based on how traders interact with the bot (and the platform).

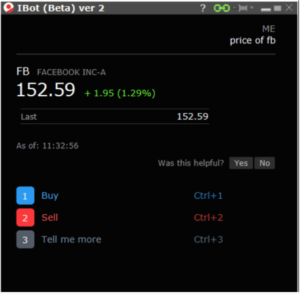

Other improvements to the interface include better presentation of information. Key elements are now easier to spot thanks to the new design which uses the full screen instead of limiting commands to text bubbles. The open interface allows for larger text display and offers more space for graphics like charts and tables.

Other improvements to the interface include better presentation of information. Key elements are now easier to spot thanks to the new design which uses the full screen instead of limiting commands to text bubbles. The open interface allows for larger text display and offers more space for graphics like charts and tables.

In addition, traders can now use keyboard shortcuts like Ctrl + 1 (Windows) or Cmd + 1 (Mac) to invoke an action.

The improved version (version 2) of IBot can be tested if traders go to the Mosaic New Window drop down and select IBot (Beta) – type to trade.

The first version of IBot was launched in the fall of 2016 with the purpose to offer users of the TWS platform a natural way to trade. The use of “natural language” means that traders may avoid the disadvantages associated with a standard interface, as they are able to speak (or type) commands without having to worry about the precise wording.

Typical commands include “Buy 300 more shares” or “Show my account margin”. Traders can also search the markets for, say, the most active US stock. IBot also provides information on market depth, simplifies work with calendar, etc.

Interactive Brokers has recently provided IBot with some extra capabilities by integrating it with its website search to allow educational and task-based returns. Thanks to this integration, IBot can answer queries like “How do I fund my account?” and “How do I transfer funds?” by returning the top five information links from the company website.

IBot is also available to users of the IB TWS app for iOS and Android mobile gadgets.