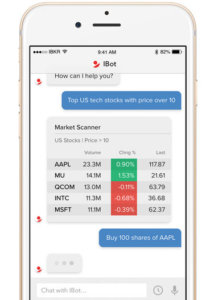

AI becomes more intelligent, as IBot searches knowledge databases via iOS devices

IBot scans knowledge databases to answer questions of users of the IB TWS application for iOS-powered devices.

The recent advances of artificial intelligence (AI) solutions into the world of online trading have been stunning – it is impressive how fast an automated program may take over customer services functions such as responding to queries about one’s account or the availability of various trading functionalities. IBot, the natural language interface to trading developed by electronic trading firm Interactive Brokers Group, Inc. (NASDAQ:IBKR), has been doing that since the autumn of 2016 and has ever since expanded into new areas.

Just a couple of days ago, Interactive Brokers made another step in the development of the capabilities of IBot. Users of the IB TWS mobile trading application for iOS-powered devices can now count on a smarter IBot, that is, the AI solution has become even more intelligent.

Just a couple of days ago, Interactive Brokers made another step in the development of the capabilities of IBot. Users of the IB TWS mobile trading application for iOS-powered devices can now count on a smarter IBot, that is, the AI solution has become even more intelligent.

IBot can search knowledge databases to provide answers to customers’ questions.

The announcement comes soon after Interactive Brokers announced that the latest beta version of the TWS platform for desktop integrates Interactive Brokers’ website search with IBot to enable educational and task-based returns. With the integration, IBot can respond to questions like “How do I fund my account?” and “How do I transfer funds?” by providing the top five best information links from Interactive Brokers’ website.

The enhancement of IBot’s functions reiterates the plausibility of the perspective of robots replacing human staff in Forex firms’ support roles. The new AI platform developed by Rakuten Inc adds weight to such a perspective, as the company will introduce chatbots with automatic response functions into customer support.

Many AI solutions that enter the online trading world, however, are not targeted at overtaking anyone’s job but rather to enhance the trading experience itself. For instance, Japanese Forex broker Monex is offering its clients a special AI-based market report.

Meanwhile, authorities in certain jurisdictions have been seeking to protect human jobs in light of the robotics’ advances in the labour market. The European Parliament has voted a resolution on the matter but the European Commission has yet to voice its stance regarding the possible job losses for human staff over robots’ dominance.