Interactive Brokers registers drop in pre-tax income in Q1 2020

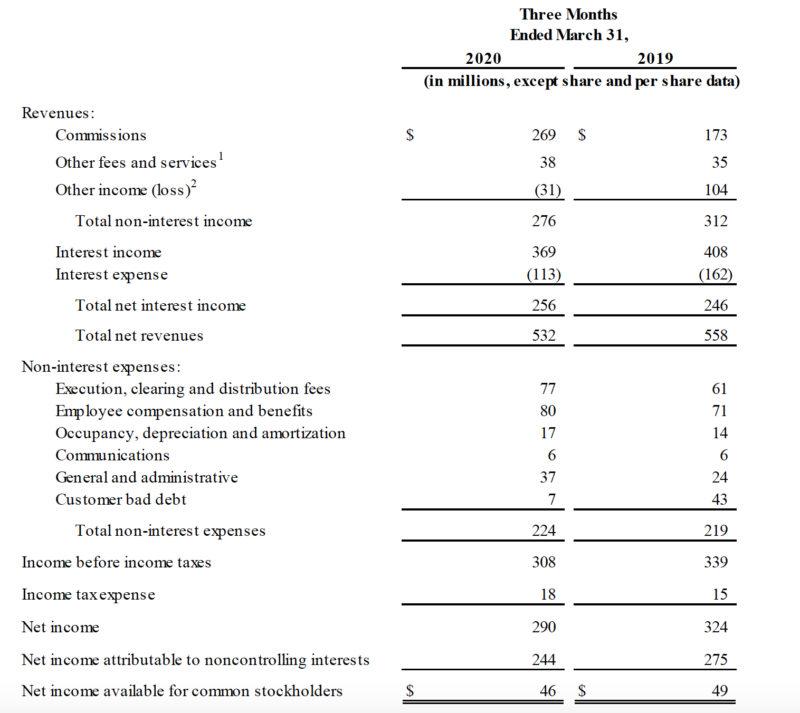

Income before income taxes was $308 million this quarter, compared to $339 million for the same period in 2019.

Online trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just reported its financial results for the first quarter of 2020.

The broker posted diluted earnings per share of $0.60 for the quarter ended March 31, 2020 down from $0.64 registered in the corresponding period in 2019, and adjusted diluted earnings per share of $0.69 for this quarter compared to $0.55 for the same period in 2019.

Net revenues for the first quarter of 2020 amounted to $532 million and income before income taxes was $308 million this quarter, compared to net revenues of $558 million and income before income taxes of $339 million for the same period in 2019.

Adjusted net revenues were $581 million and adjusted income before income taxes was $357 million this quarter, compared to adjusted net revenues of $468 million and adjusted income before income taxes of $291 million.

Commission revenue increased $96 million, or 55%, from the year-ago quarter on the back of higher customer trading volume in an environment of high market volatility resulting from the COVID-19 pandemic.

Net interest income increased $10 million, or 4%, from the year-ago quarter as average customer credit balances and average customer margin loan balances increased from the year-ago quarter, partially offset by a lower average Federal Funds effective rate, which decreased to 1.25% from 2.40% in the year-ago quarter.

On the downside, other income decreased $135 million from the year-ago quarter mainly comprised of:

- $111 million related to Interactive Brokers’ strategic investment in Up Fintech Holding Limited (Tiger Brokers), which swung to an $8 million mark-to-market loss this quarter from a $103 million mark-to-market gain in the same period in 2019; and

- $30 million related to Interactive Brokers’ currency diversification strategy, which lost $49 million this quarter compared to a loss of $19 million in the same period in 2019.

Total equity was $8.1 billion.

The Interactive Brokers Group, Inc. Board of Directors declared a quarterly cash dividend of $0.10 per share. This dividend is payable on June 12, 2020 to shareholders of record as of June 1, 2020.