Interactive Brokers’ TWS platform switches to more precise Mark Price IV calibration method

The new Mark Price IV calibration method provides a better and more comprehensive volatility surface.

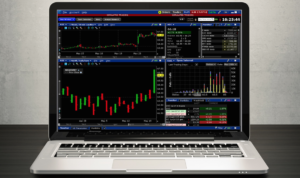

Online trading services provider Interactive Brokers Group, Inc. (IBKR) has added more functionalities to the latest (beta) version of its TWS platform. The most recent additions include a new Mark Price Implied Volatility (IV) calibration method.

The broker explains that it has recently switched to a more precise Mark Price IV calibration method that provides a better and more comprehensive volatility surface. This results in improved model price and Greeks in TWS especially for deep in-the-money or far out-of-the-money options.

Traders can see the applied IV skew curve in the Implied Volatility Viewer – they just have to use the Search field in the Mosaic New Window drop-down to find the tool.

Speaking of volatility, let’s recall that in April this year, Interactive Brokers bolstered its 3D Volatility Surface webtool. Traders can now view Implied Volatility in 3D using the 3D Volatility Surface webtool accessible from within the Implied Volatility Viewer. All they have to do is click the “3D” button to study the model volatility surface of contracts in 3D.

As a result, the platform displays the model surface together with individual option IV points. And traders can also compare the current surface with any historical value by plotting them together. The view can be rotated and zoomed. If one expands the “Extra plot controls”, contour and value lines will be shown. Scaling can be manipulated using sliders.

The latest (beta) release of TWS also offers a raft of search enhancements. Thanks to the new auto-complete “Search” fields included on menus, in the New Window drop-down, and in the right-click menu from any symbol in your Watchlist, Portfolio or trading page, now it has become easier to access the tools and information one needs within TWS. Traders can avoid navigating through multiple layers of menus by simply typing what they need in the relevant search field and clicking the desired result to load the tool or window they need.

Traders can click the Mosaic Account menu, and instead of navigating down to Activity and then to Activity Statements, they can simply start typing “Activity” in the Search box.