Jailed UBS and Citi trader Tom Hayes “denied fair trial” say his lawyers to Court of Appeal

First came the multi-billion dollar regulatory penalties. Then came the civil litigation which ran into the billions. Then came the criminal prosecutions of individual traders. Now, one year after the first decisions by authorities were being made with regard to the wave of FX rate manipulation efforts by major banks in London and in the […]

First came the multi-billion dollar regulatory penalties. Then came the civil litigation which ran into the billions. Then came the criminal prosecutions of individual traders.

Now, one year after the first decisions by authorities were being made with regard to the wave of FX rate manipulation efforts by major banks in London and in the wake of the LIBOR rigging scandals, the lawyers are at it again, this time in attempts to appeal rulings made by courts against traders.

Tom Hayes, a former UBS and Citi yen derivatives trader who was handed a 14 year jail sentence in August this year after being found guilty of eight charges of conspiracy to defraud as a result of his part in the LIBOR rigging saga, has only served 3 months of his sentence and his lawyers have now taken his case to the Court of Appeal, on the basis that they believe that Mr. Hayes was not given a fair trial.

According to various reports, the team of lawyers representing Mr. Hayes believe that the jail sentence is far too harsh, largely because Mr. Hayes’ defense was prevented from delivering key evidence.

At the time of sentencing, famous ‘rogue trader’ Nick Leeson, who had brought down Barings in the early 1990s and served a jail term, his trading escapades later becoming the subject of a movie, had stated he believes Mr. Hayes’ sentence to be “too heavy.”

The barrister representing Mr. Hayes is Neil Hawes, who has stated that Judge Jeremy Cooke had prevented him from referring the jury to a prevailing culture within the banking industry between 2006 and 2010 during the judge’s closing speech at the trial.

Mr. Hawes states that he had intended to point out during the trial that it was commonplace during that particular four year period for banks to routinely influence LIBOR rates for commercial reasons, and that the jury should have been allowed to be free to consider whether Mr. Hayes specifically acted dishonestly compared to the general industry behavior at the time.

Mr. Hawes said

“The jury were entitled to take into consideration surrounding circumstances,” Hawes told the appeals court. In judging standards of reasonable and honest people, you have to have regard to the conduct of the market.”

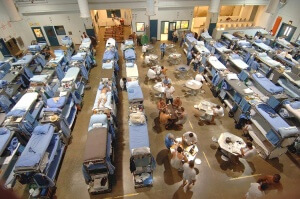

14 years is a very long time to eat porridge, however Mr. Hayes continues to deny that he acted dishonestly, and the appeal will likely go ahead and be reviewed accordingly.