Japanese brokerage Monex to extend the period of free equity trading on TradeStation

No equity trading fee will be charged on “TradeStation” trading tool up to three months.

Monex Inc, a part of Monex Group, Inc. (TYO:8698), today announces changes to the trading terms concerning the TradeStation platform.

The brokerage says it will expand eligibility of Margin Trading Support Program and extend the period of free equity trading on “TradeStation”, a Japanese equity trading tool for active traders. According to the plan, the changes will get into effect on Monday, November 18, 2019.

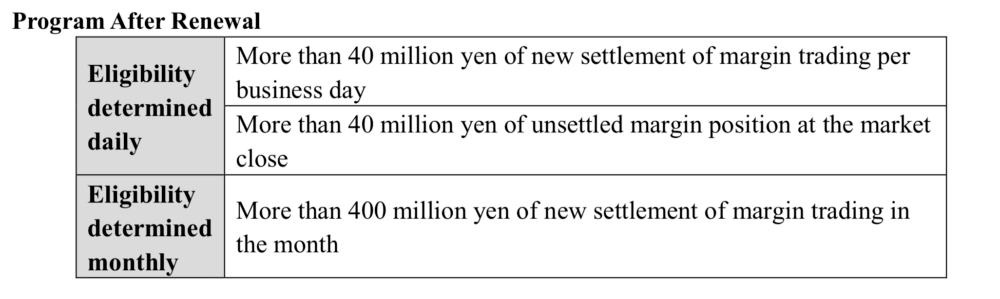

“TradeStation” will now have two frequencies, daily and monthly, for determining the eligibility of the program, as opposed to the single weekly basis up to present. Customers who meet one of the conditions are eligible for cash equity trading and margin trading free of charge for up to three months. Monex will also relax some of the other conditions.

Via these changes, Monex hopes to offer opportunities for existing customer and as many new active traders in Japan as possible to leverage the power of the Japanese equity trading tool, based on the system of US online trading company TradeStation Group, Inc.

After the program change, if one of the above conditions is met, no equity trading fee will be charged from the second business day after the condition is met to the end of the second month (for up to three months).

Let’s recall that, in July this year, Monex lowered the minimum fee for U.S. equities trading to US$0 (free of charge) for trades that are executed from Monday, July 22, 2019. The company explained that the change will enable its customers to benefit from its unique U.S. equities trading services with lower cost.