Jefferies Financial Group registers net income of $45m in Q1 FY19

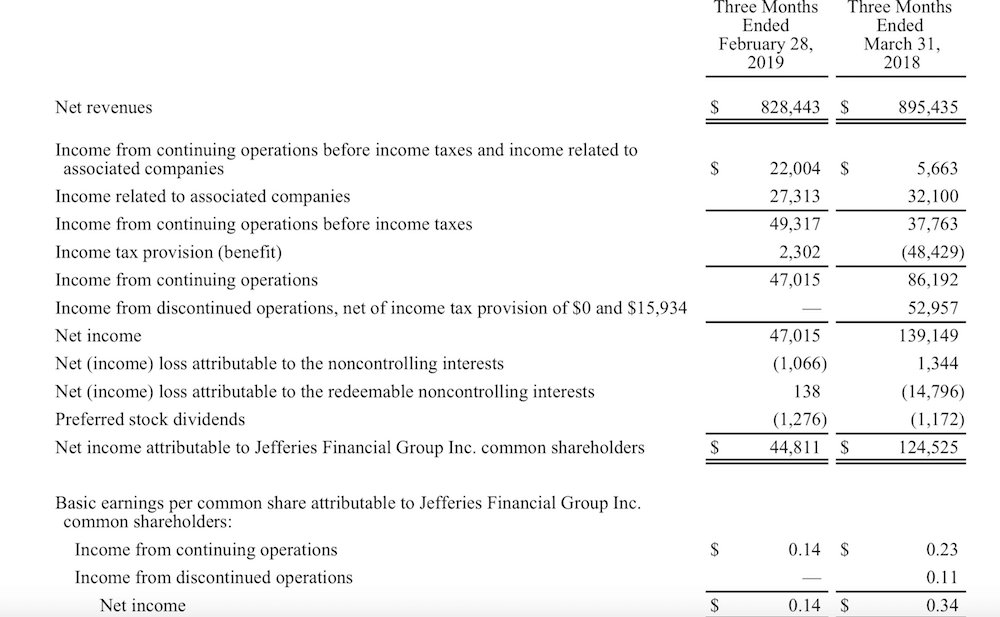

Net income attributable to Jefferies Financial Group common shareholders amounted to $45 million during the three months to end-February 2019.

Jefferies Financial Group Inc (NYSE:JEF), formerly known as Leucadia National Corporation, has just posted its financial results for the first quarter of FY 2019, that is, for the three months to February 28, 2019.

Net income attributable to Jefferies Financial Group common shareholders amounted to $45 million during the three months to end-February 2019, markedly down from $124.5 million from the three-month period to end-March 2018. The net income for the first quarter of FY 2019 was $0.14 per diluted share, down from $0.34 in the quarter to end-March 2018.

Jefferies Group (Investment Banking, Capital Markets and Asset Management) registered pre-tax income of $63 million and total net revenues of $686 million. Investment Banking Net Revenues totalled $278 million, below-normal due to the impact of market conditions in December and the shutdown of the U.S. Government in December.

Jefferies Financial Group had parent company liquidity of $1.5 billion at February 28, 2019.

Rich Handler, Jefferies Financial Group CEO, and Brian Friedman, Jefferies Financial Group President, voiced their satisfaction with the first quarter results, explaining that these reflect resilient and solid performance in the face of an extremely challenging environment. The management conceded that the trading environment was especially poor throughout December and the Group’s results in both Equities and Fixed Income are excellent considering the volatility and risk of this period.

The management noted that activity was very light during the December market downturn and this was further exacerbated by the government shutdown for five weeks to the end of January.

“With the U.S. Government open for business, the new issue markets snapped open in March and our business has resumed its more normal pace. Our current Investment Banking backlog for capital raising and mergers and acquisitions is robust and the trading environment is good. We expect to continue to reap the benefits of high quality new hires we have made across our platform, particularly in Investment Banking”, Rich Handler and Brian Friedman said.

“Our first quarter results were negatively impacted by a $25 million non-cash decrease in the mark-to-market value of our oil hedge portfolio within our Vitesse investment, as oil prices recovered to $57/bbl from $51/bbl at November 30, 2018. Excluding the impact of the fair value decline, Vitesse’s adjusted pre-tax income was $10 million. This hedge portfolio represents options and collars intended to effectively assure the sale of Vitesse’s expected next one to two years’ worth of oil production at prices we deem attractive”, the management said.

Today’s press release did not include any information about FXCM but it is likely that the Form 10-Q, expected to be filed on or about April 9, 2019, will provide some update.