Jefferies posts net income of $671m for Q2 2019

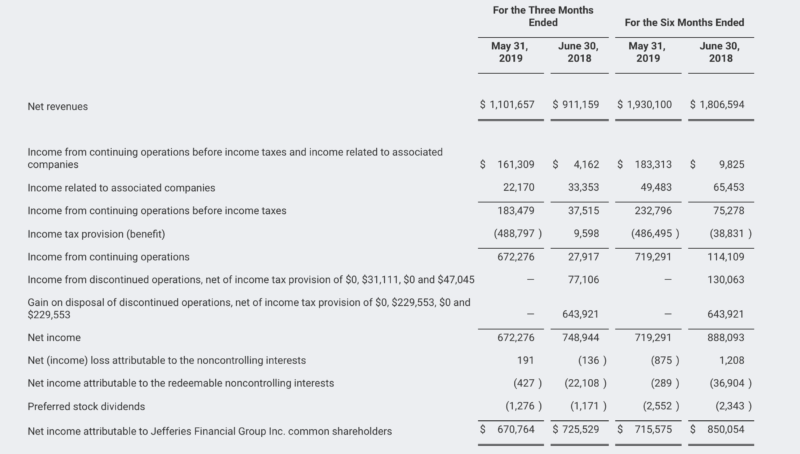

The net income attributable to Jefferies Financial Group common shareholders amounted to $671 million, or $2.14 per diluted share, in the quarter to end-May 2019.

Jefferies Financial Group Inc (NYSE:JEF), formerly known as Leucadia National Corporation, today announced its financial results for the three and six month periods ended May 31, 2019.

In the quarter ended May 31, 2019, net income attributable to Jefferies Financial Group common shareholders amounted to $671 million, or $2.14 per diluted share, including the impact of a nonrecurring tax benefit of $545 million. Adjusted net income for the three-month period totalled $126 million, or $0.41 per diluted share.

Jefferies Group (Investment Banking, Capital Markets and Asset Management) recorded pre-tax income of $155 million and net earnings of $110 million in the second quarter of 2019.

The Group reported total net revenues of $902 million for the quarter to end-May 2019, with Investment Banking net revenues amounting t $448 million, Total Equities and Fixed Income net revenues amounting to $379 million, and Asset Management revenues amounting to $53 million.

The Group repurchased 7.8 million shares for $150 million, or an average price of $19.33 per share.

Jefferies Financial Group had parent company liquidity of $1.3 billion at May 31, 2019.

In the six months ended May 31, 2019, net income attributable to Jefferies Financial Group common shareholders amounted to $716 million, or $2.25 per diluted share, including the impact of a nonrecurring tax benefit of $545 million. Adjusted net income amounted to $171 million, or $0.54 per diluted share.

Total Net Revenues for the six-month period were $1,588 million. During the half-year to May 31, 2019, the Group repurchased 17.4 million shares for $344 million, or an average price of $19.86 per share.

Rich Handler, our CEO, and Brian Friedman, our President, said:

“Jefferies Group, our financial services business, produced solid and promising performance in the second quarter in Investment Banking, Capital Markets and Asset Management. Overall Investment Banking results returned to more normal levels, although our Investment Banking advisory revenues were held back by the lag effect resulting from capital markets conditions in December and the U.S. government shutdown in December and January. We continue to take market share in our Equities business and posted solid results in our Fixed Income business on the back of strength in our credit businesses. Good results for the second quarter and first half of the year in our Asset Management business suggest we are making continued progress toward building this business. Return on equity for Jefferies Group was 7.1% and return on tangible equity3 was 10.2%.

“In the third quarter, we believe Investment Banking will continue to deliver solid results (subject to market conditions), as our transaction backlog is robust and we are seeing positive trends in both the M&A and leveraged finance markets. Additionally, we are optimistic regarding the increasing productivity of managing directors we hired during the last several years. In particular, we are expecting Investment Banking revenue growth in both the U.S. and Europe from a large number of our recently hired coverage managing directors in our Industrials, Technology and Consumer groups, as they continue to gain traction. We currently have 865 investment banking professionals globally, of which 212 are managing directors. The quality of our brand, human capital and market position has never been stronger.

“During the second quarter, in connection with the closing of our corporate available for sale portfolio, we realized a non-cash tax benefit of $545 million. This tax benefit was generated primarily through activity during 2008-2010 and since then has remained an unrealized balance within equity until the liquidation of the portfolio. This realization did not impact total equity, as the increase in retained earnings was offset by a corresponding decrease in accumulated other comprehensive income.”

A detailed financial report will be included in Form 10-Q to be filed with the Securities and Exchange Commission (SEC) on or about July 9, 2019.