June Felix buys more shares in IG Group

IG Group’s CEO has earlier this week bought 25,800 Ordinary Shares in the brokerage.

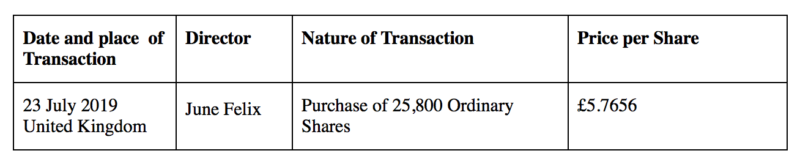

Online trading major IG Group Holdings plc (LON:IGG) today reported recent transactions in its shares. On July 24, 2019, IG was notified of transactions carried out in respect of its ordinary shares of 0.005p each by June Felix, Chief Executive Officer.

Ms Felix purchased 25,800 Ordinary Shares at a price of £5.7656 each. This results in an aggregated price of £148,752.48.

The transaction was conducted on the same day on which IG reported its preliminary results for the twelve months to the end of May 2019, with profit after tax for the period at £158.3 million, down 30% from the preceding year.

Total operating costs for the year to May 31, 2019 amounted to £284.3 million, down 2% from the year before. Operating profit was £192.9 million, down 31% from £281.1 million registered in FY18.

The Group’s net trading revenue in FY19 was £476.9 million, 16% lower than the £569 million registered in FY18. This result is in line with previous guidance. Revenue generated from clients in the ESMA region in FY19 was 26% lower than in FY18, with 2% growth in revenue from clients in the Group’s businesses in the rest of the world.