KBW Associates Ltd informs FCA of filing for liquidation

The UK regulator advises clients to contact the Financial Services Compensation Scheme to discuss how to register a claim.

KBW Associates Ltd, claiming to be “London’s premier investment boutique”, has informed the UK Financial Conduct Authority (FCA) that it has filed for liquidation. The relevant announcement was made by the UK regulator today.

The website of KBW Associates Ltd is still active at the time of publication of this article and shows no information to clients of the company with regard to the liquidation. Instead, the website touts the offering of KBW, which is supposed to include “an extensive range of global markets and asset classes”. KBW Associates claims that “In partnership with the UK’s Number 1 online trading company we can provide clients with exposure to over 10,000 markets, including 7,000 Equity CFD’s and over 60 Foreign Exchange pairs”.

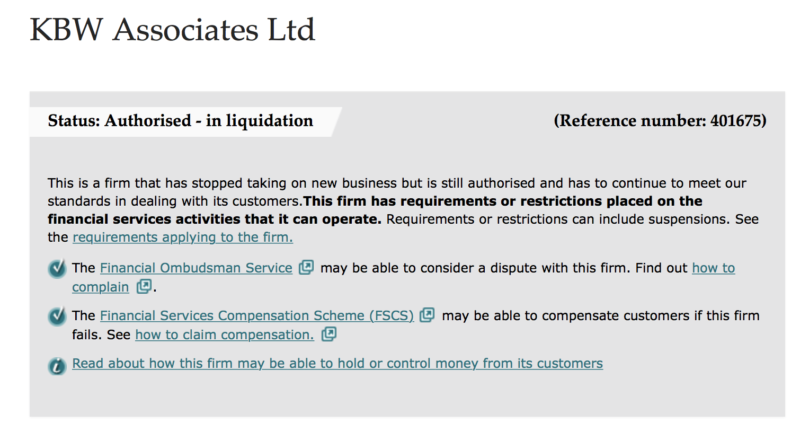

The FCA register shows the company is in liquidation.

The FCA advises any client who is considering submitting a claim to contact the Financial Services Compensation Scheme (FSCS) to discuss how to register a claim.

In addition, clients who have already complained to the Financial Ombudsman Service should speak to their case handler to discuss next steps, including whether their complaint will be transferred to the FSCS for consideration.

The UK Companies House service shows that the latest KBW Associates accounts made up to 28 February 2018 were due by 30 November 2018. They were not filed on time and are currently overdue.