Latest UK foreign exchange turnover survey shows falls across all instruments

FX Swaps and Currency Swaps saw the largest relative falls, $291 billion (-20%) and $15 billion (-37%) respectively.

The Bank of England (BoE) today posted the key results from an April 2020 survey of financial institutions that are active in the UK foreign exchange market. In April, 27 financial institutions active in the UK participated in the semi-annual turnover survey for the Foreign Exchange Joint Standing Committee (FXJSC).

Average daily reported UK foreign exchange turnover was $2,412 billion per day in April 2020, falling 16% from the record highs seen in the October 2019 survey, and 15% from the April 2019 survey.

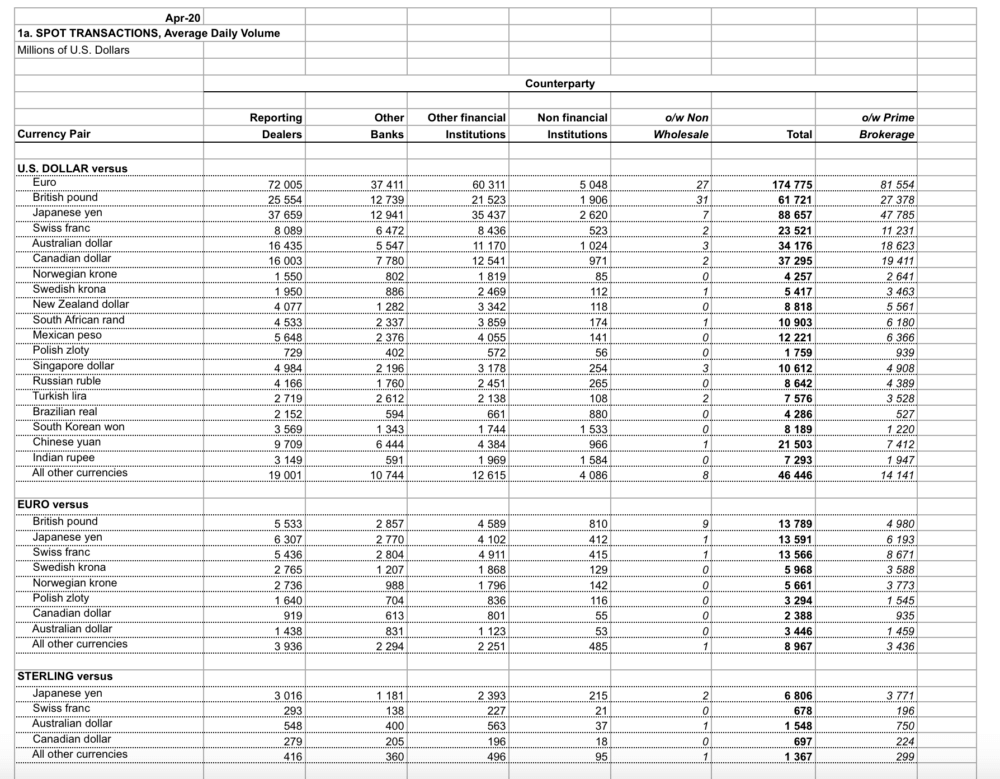

The survey reveals consistent falls were seen across all instruments. FX Swaps and Currency Swaps saw the largest relative falls, $291 billion (-20%) and $15 billion (-37%) respectively, having both seen record high average daily turnover in the October 2019 survey. Spot activity also declined, with average daily turnover of $677 billion, a reduction of 10% relative to the previous reporting period in October 2019.

Comparing to April 2019, there were similar falls in Spot (-14%) and FX swaps (-17%). FX Options and NDFs also fell in comparison to the April 2019 survey, while currency swaps rose slightly (5%).

All major currency pairs had seen falls in average daily turnover since the last survey in October 2019. Sterling activity fell more than most, with average daily turnover for USD/GBP and EUR/GBP falling by $138 billion (-32%) and $24.7 billion (-31%) respectively, having both seen record highs in October 2019. USD/JPY returned to be the second most traded currency pair, with an average daily turnover of $313.5bn (-6% from October 2019).