Let the income flow with these FTSE 100 utility giants

London Stone Securities stockbroker Caoimhe O’Driscoll looks at some historically safe haven blue chips which are trading at attractive entry levels. She provides an analysis looking at dividends, dividend cover, RSI, support and resistance levels.

By Caoimhe O’Driscoll ACSI, Stockbroker, London Stone Securities

Utilities and historical safe haven stocks have fallen sharply recently on the back of Trump surprising the market with his election win. This unexpectedly caused a ‘risk on’ trend in the market to develop – with investment in the miners and oil sector and disinvestment from the defensive stocks.

The shares below are all trading at highly attractive entry points and are low compared to recent levels. At London Stone we believe each would act as a good constituent in a portfolio over the next few weeks as Trump’s policy and administration remains uncertain, as does the debate between parliament and government over Brexit, and the Italian and French elections loom.

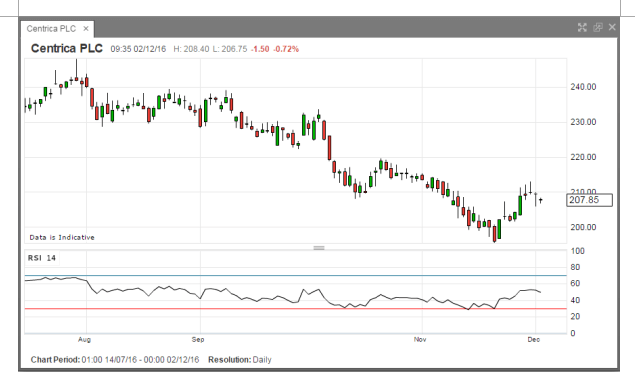

Centrica (CNA.L)

Dividend 5.7%. Cover 1.4.

Centrica’s cost and efficiency savings are progressing well enough and capital expenditure (capex) is being reduced. This is helping to support cash flows, dividends and net debt reduction. The group has stated that even if current commodity prices persist it should still be able to grow its operating cash flows, while capex in the upstream business can be reduced further if necessary. This should help underpin confidence in the dividend. Centrica has nearly 30 million customer relationships in the UK and North America and a strong, well-recognised brand. If the group can leverage these strengths, through cross-selling additional services, while improving efficiency, it should can grow in the long run. 200p historically acts as a strong support level as the stock is generally range bound.

- The RSI which indicates if a stock is overbought or oversold is currently 49.36. Near 30 is oversold and near 70 is overbought. CNA is in the neutrality area.

- Beta: 1.17

- Year High: 248p

- Year Low: 182p

| Resistance 1 | 210.93 |

| Resistance 2 | 212.47 |

| Resistance 3 | 214.98 |

| Support 1 | 206.88 |

| Support 2 | 204.37 |

| Support 3 | 202.83 |

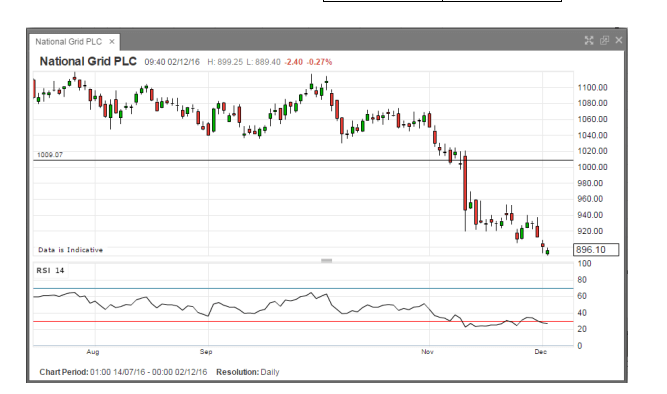

National Grid (NG..L)

Dividend 4.8%. Cover 1.5.

National Grid could benefit from the election of Donald Trump if he presses ahead with plans to upgrade US infrastructure. CEO Pettigrew welcomed positive comments about infrastructure from the president-elect, who has highlighted investing in “a modern and reliable electricity grid” as one of his key infrastructure priorities.

He added: “Our major businesses in the US are gas distribution and electricity distribution, which are predominantly regulated at the state level. But we will look forward to working with the Trump administration.” National Grid’s operating profits recently rose 1% to £1.85bn. While primarily known in the UK for its role managing the electricity and gas networks, it also has a substantial business in New York, Rhode Island and Massachusetts. It invested more than £1bn in its US businesses in the six months to September – roughly half its overall group investment.

- NG’s RSI is at a low level of 27.29 – oversold

- Beta: 0.48

- Year High: 1148p

- Year Low: 893p

| Resistance 1 | 908.72 |

| Resistance 2 | 917.23 |

| Resistance 3 | 925.42 |

| Support 1 | 892.02 |

| Support 2 | 883.83 |

| Support 3 | 875.32 |

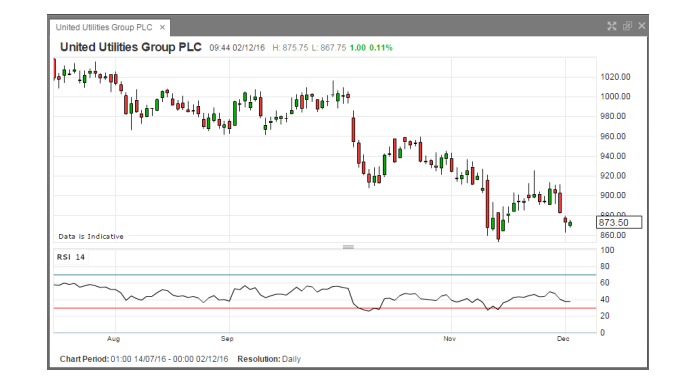

United Utilities (UU..L)

Dividend 4.4%, cover 1.2.

Recent share price weakness now implies a total shareholder return of 18%. The stock has underperformed the FTSE 100 by 11% since the 2 October Tory Party conference. United Utilities can be attractive in times of economic uncertainty, as consumers are unlikely and sometimes unable to cut back on such everyday essentials.

The recent history and potential direction of the sector, from an equity investor standpoint, can be explained by worries about falling real gilt yields, preferences for low risk income and concerns about regulation and liberalisation. Current trading is in line with the group’s expectations. Reported group revenue is expected to fall slightly, reflecting the accounting impact of the Water Plus joint venture with Severn Trent, while underlying operating profit is expected to be slightly ahead of the first half last year.

- The RSI is oversold at 37.88

- Beta: 0.59

- Year High: 1064p

- Year Low: 853.50p

| Resistance 1 | 880.92 |

| Resistance 2 | 888.83 |

| Resistance 3 | 897.92 |

| Support 1 | 863.92 |

| Support 2 | 854.83 |

| Support 3 | 846.92 |

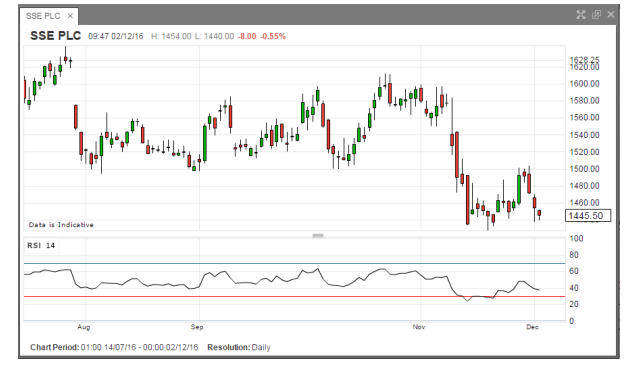

Scottish Southern Energy (SSE.L)

Dividend 6.1%. Dividend cover is 1.3.

Beta is 0.96. Energy giant SSE is preparing for record annual investment and capital expenditure of around £1.85bn next year. Following its sale of a 16.7 per cent stake in Scotia Gas Networks in October, management has announced plans to direct £100m towards construction of the 225 megawatt Stronelairg wind farm. The remaining proceeds will finance a share buyback of around £500m. Revenues and earnings have been relatively stable in recent years, and there has never been much hope of significant capital growth in this sector, as solid reliable income provides the main attraction. SSE remains an attractive investment for those seeking strong dividends with relatively low risk.

- RSI is oversold at 37.46

- Beta: 0.99

- Year High: 1644p

- Year low: 1317p

| Resistance 1 | 1470.17 |

| Resistance 2 | 1486.33 |

| Resistance 3 | 1502.67 |

| Support 1 | 1437.67 |

| Support 2 | 1421.33 |

| Support 3 | 1405.17 |

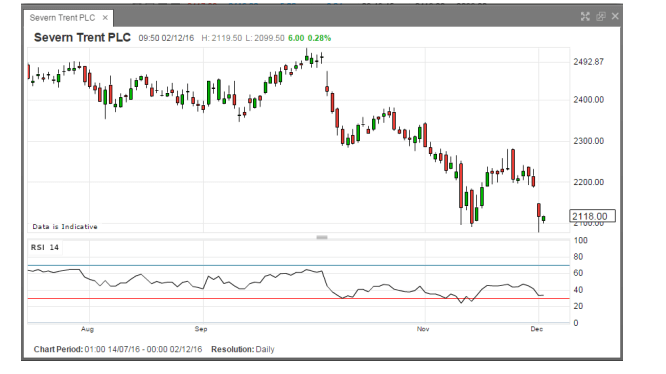

Severn Trent (SVT.L)

Dividend 3.8%. Dividend cover is 1.3.

Severn Trent has agreed to buy smaller listed water service provider Dee Valley Group for about £78.5m. Ancala Fornia, an infrastructure investment manager, had agreed to buy Dee Valley for about £71.3m in October, but Severn Trent said that the “Dee Valley board had withdrawn its recommendation” of the acquisition. The acquisition, which is expected to be earnings enhancing for the group, expands subsidiary Severn Trent Water’s offering in the area around Wrexham in Wales and south of Liverpool in England.

Over £3bn will be invested in AMP6, an asset management programme for water companies to improve efficiency and wastewater quality, and the company said it will support continued investment in infrastructure in the Dee Valley region. The acquisition is expected to deliver attractive returns as the company will apply its operating model, economies of scale and lower cost financing for operations. The purchase of Dee Valley represents an opportunity for Severn Trent to apply its successful operating model for the benefit of customers across an enlarged asset base, in a neighbouring geographic area.

- RSI is oversold at 33.67

- Beta: 0.57

- Year High: 2526.00p

- Year low: 2024.00p

| Resistance 1 | 2150.50 |

| Resistance 2 | 2185.00 |

| Resistance 3 | 2221.50 |

| Support 1 | 2079.50 |

| Support 2 | 2043.00 |

| Support 3 | 2008.50 |

Charts courtesy of London Stone Securities