Like them or loathe them, Plus500’s stock is number 2 investment of entire year!

Of all FTSE 350 listed stock in the UK across all business sectors, Plus500 was number 2 in terms of investor return for the entirety of 2018. demonstrating the market entry and exit acumen of its founders.

As the end of 2018 approaches and the vast majority of hard-working, dedicated FX industry professionals, brokerages, technology developers, liquidity providers, bankers and traders take a week or more break and a well deserved seat at the table to enjoy their festivities, the stock market’s winners and losers for 2018 are beginning to make themselves clear.

Ordinarily, looking at which blue chip pharmaceutical giant or gray suited management consultancy maintained a steady share price through a year of anodyne board meetings, never ending contract renewals and corporate governance policy would be a perfect antidote to insomnia, however this year something remarkable has occurred.

Retail FX and CFD brokerage Plus500, itself only propelling itself into public listing on the London Stock Exchange’s Alternative Investment Market (AIM) just five years ago as a lean commercial operation became the envy of the retail FX industry with a very clever proprietary digital marketing system that created a massive advantage in terms of operational and customer acquisition efficiency almost by accident just a few years prior at the firm’s original base in Haifa, Israel.

The company, which in terms of headcount and operational size is a fraction of the size of the 30 year established publicly listed electronic trading giants among which it now nestles in London’s Square Mile, and whilst its success and business model is the bete noire of many long term FX industry professionals, this year’s stock market results are testimony to the success of Plus500’s business model.

Unbelievably, Plus500’s stock is the number 2 best performing stock for all of 2018, in every business sector across all of Britain’s publicly listed companies.

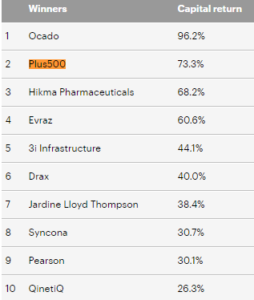

Out of the FTSE 350 stocks that AJ Bell calculated, Plus500 came in at number 2 for the entire year, falling behind only one company, that being multi-channel supermarket delivery firm Ocado which delivers food for British supermarkets to retail consumers on a nationwide basis.

Ocado aced the stock market this year, with a 96.2% capital return for investors, however Plus500 came in at number 2 with a 73.3% return for investors, beating every company on the entire FTSE 350 index in the entire country on that particular index apart from Ocado.

City insiders say that Ocado began to persuade investors that it was indeed really a software and technology play, rather than a marginally-profitable delivery firm. The company signed more licensing deals for its Ocado Solutions technology and the shares roared higher, helped by a massive ‘bear squeeze,’ as short-sellers of the stock gave up betting on its shares going down over the summer.

Short sellers then scrambled to buy stock to cover their short positions, driving the share price to new highs. However, Ocado has drifted lower by quite some way from its highs.

Indeed, the Old School Tie Network may not like Plus500 and see them as an upstart that rose to becoming a $1 billion company within a very short time of having listed stock on the London Stock Exchange.

In May 2015, the FCA instigated an account freeze on all of Plus500’s retail trading activity, decimating its share prices overnight.

In October that year, FinanceFeeds researched this in detail and has discovered that some rival firms do not relish the thought of overseas competitors setting up shop on their territory, and have implemented methods by which to cause such companies commercial harm.

According to a number of sources close to the matter, Plus500 UK’s restriction was initiated by a series of competing companies having close relationships with FCA officials, and in some cases recruiting former FCA officials to work in departments dedicated to researching what could be deemed as malpractice by competitors in order that they can use their channels and connections to converse with officials in order to put a metaphorical spanner in their works.

This however did not work, as very soon after the FCA lifted the account freeze, Plus500 was back to its normal operating capacity and its market capitalization back to over $1 billion.

During the course of such a high return year in terms of stock, many of the original founders divested entirely from Plus500, those being Alon Gonen, Gal Haber, Elad Ben-Izhak, Omer Elazari and Shlomi Weizmann who in May this year announced their official plan to sell in aggregate approximately 7.27 million existing ordinary shares in the capital of the Plus500 at a price of £11.00 per placing share netting them $80 million in total.

One bitter commenter stated this week “the only winners are the fund managers who get paid no matter how well your investments perform.” Well, not really. If you are a retail trader and are managing your own finances via one of the proprietary platforms, you are master of your own destiny.

The difference is that if your broker is Plus500, you would this year have been able to profit from the continually buoyant prices of their shares. Or alternatively to have the foresight and business acumen of the founders of Plus500 who got into the market at the right time, kept it lean, went public in London and increased their client base whilst keeping the cost of operations down, and got out at the right time too.