LINE teams up with FOLIO to launch new mobile investment service

The service encourages first-time and novice investors to build wealth by investing in familiar themes through the LINE app.

The LINE app has just brought a raft of investment opportunities closer to newbie investors in Japan. LINE Financial Corporation and FOLIO Co., Ltd. (FOLIO) have partnered on the launch of a new service called “LINE Smart Invest”.

This is a new mobile-based investment service aiming to make investing fun and easy for inexperienced users. In order to build their wealth, users can access the service from the LINE app and start investing in a variety of themes (currently around 70), such as drones, young women’s trends, VR, and cosplay, based on their personal preference. By offering theme-based investment products at an average minimum investment of JPY 100,000, and adopting portfolio diversification that mitigates stock price volatility risks, this next-gen service provides asset-building opportunities to a wider range of users.

LINE Smart Invest is based on FOLIO, the next-generation investment service that went into full-scale operation on August 8th.

The new service is launched in response to certain recent developments in the investment landscape in Japan. Many people in Japan are concerned about the assurance and stability of their post-retirement years, LINE and FOLIO explain. With the falling birth rate putting a strain on the country’s pension system, changing working conditions chiseling retirement bonuses, and ultra-low interest rates, building wealth through investments is no longer without implications for many.

At the same time, the untapped market population of potential investors who “want to invest but don’t know where to start” is estimated at around 20 million in Japan. Despite their interest in asset-building, the majority renounce due to their “lack of knowledge,” “fear of losing money,” and assumption that “investing is complicated and overly sophisticated”.

To change this situation and accelerate the paradigm shift from saving to asset-building, the operators of LINE and FOLIO decided to team up and enter into a capital alliance in January 2018.

The latest service combines the LINE messaging app, boasting 76 million monthly average users in Japan, and FOLIO, offering investment products on day-to-day themes.

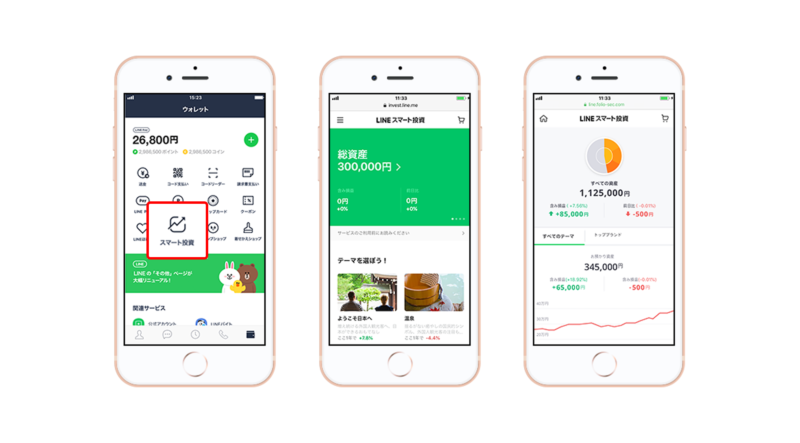

LINE Smart Invest is accessible from the LINE Wallet tab in the LINE app, along with the LINE Pay mobile remittance and payment service, and LINE Insurance. The lineup of theme-based investment products is carefully selected by professionals – which eliminates the need for specialized knowledge about individual stocks. FOLIO offers investment products on approximately 70 different themes – VR, e-sports, cosplay, drones, and more – spanning 11 categories including “Cutting-edge technologies that will change the world,” and “Invest in your passions.”

The UI is designed to be clear and intuitively operable to reduce investment barriers and make asset-building fun for first-time and novice investors. Whereas reference pages on investments tend to be cluttered with information, LINE Smart Invest’s design is mobile-first, focusing on orderliness by displaying accurate information cohesively, and making sure that the design does not cause anxiety or confusion among users.

Regarding the future of the new service, LINE Financial and FOLIO say they will leverage their technologies, and plan to add new features such as the “Recommended portfolio,” allowing for optimized, low-cost wealth management with a simple questionnaire, as well as to enable fund settlements through LINE Pay. The companies will also take into account user feedback as well as the service’s usage data when they consider future service improvements.