Liquidators of New Zealand FX broker LQD Markets grapple with assets recovery

The major asset still to be released appears to be a debt due from LQD Markets (UK) Limited – currently in administration.

Although the “Black Swan” events from January 2015 may seem to belong to the past, for some companies and their clients they still determine an active part of their present. Such is the case with Liquid Markets, a now-defunct FX broker with operations in several countries, including the UK and New Zealand. The company filed for administration shortly after the January 15, 2015 events.

Administrators (and liquidators) of LQD Markets (UK) Limited and New Zealand-based LQD Markets Limited continue to push for the realization of assets, investigating into what led to the huge client money deficit and into working with client claims.

The latest report by Gerry Rea Partners, liquidators of New Zealand’s LQD Markets Limited, does not provide an optimistic piece of news to the shareholders and creditors of the now-inactive broker. Realizations for the liquidation to date (the period covered by the report is from September 12, 2016 to March 12, 2017) amount to humble NZ$5,145, whereas the funds on hand in the liquidators’ trust account total NZ$452.

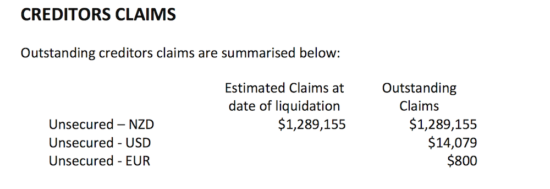

This compares with outstanding creditors’ claims exceeding NZ$1.29 million.

The report notes that the major asset yet to be realized appears to be a debt due from LQD Markets (UK) Limited which is in administration. A creditors claim has been filed in the administration and Gerry Rea have been appointed to the creditors committee of LQD Markets (UK) Limited. There remains a shortfall in assets which the liquidators continue to investigate.

The liquidators also highlight that the broker’s records were not up to date. 29 additional creditors have come to light although not all have made a claim.

Given the outstanding matters, Gerry Rea Partners say that at present it is not possible to estimate the date of completion of the liquidation.

The report by Gerry Rea Partners is released less than a month after the Joint Special Administrators from RSM have published their Fourth Report into LQD Markets (UK) – the document covers the period from August 2, 2016, to February 1, 2017.

To date, administrators from RSM have agreed 555 client claims for an approximate amount of $4.38 million. That does not seem like much of a progress being made, as a year earlier, the JSAs said they had agreed to the claims of 546 clients for a sum of $4,342,982.11. The latest report confirms that the client deficit is $2,911,894.60, well above the sum estimated shortly after the broker filed for administration.