Lucid Markets LLP ceases to be authorized by FCA

The company ceased to be authorized by the Financial Conduct Authority effective November 23, 2018.

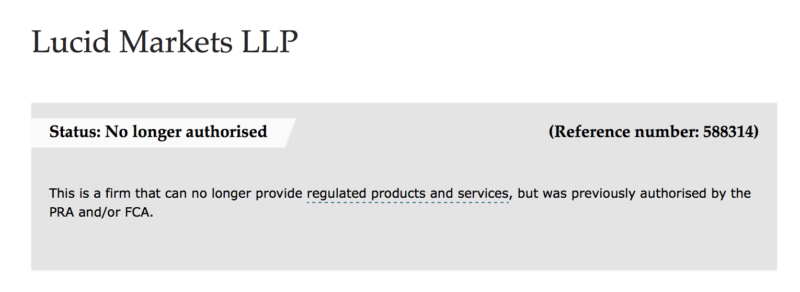

Further to FinanceFeeds’ report about the application of Lucid Markets LLP to cancel its FCA authorization, there has been an update, as the UK Financial Services Register shows the company is no longer authorized.

The change in the status became effective on November 23, 2018.

Let’s recall that, in January 2018, the designated members of Lucid Markets LLP, a wholly owned subsidiary of Lucid Markets Trading Limited, announced their intentions to sell the exchange memberships and wind down the LLP in an orderly manner. The reasons for this decision were recent losses and that current projections saw no medium to long-term return to profitability for the LLP. The partners have informed the relevant regulators of the partnership’s intention to exit the market.

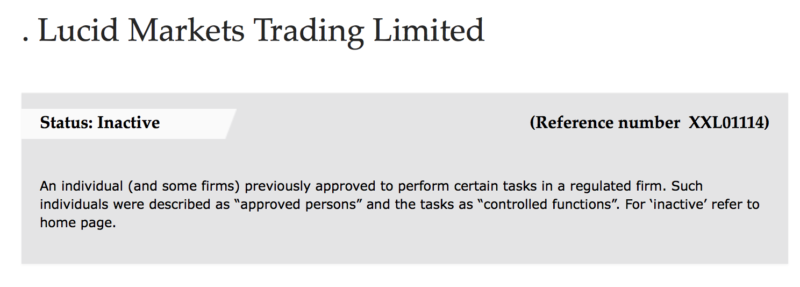

According to filings with the UK Companies House made in early October this year, as a result of the decision to wind down the LLP, Lucid Markets Trading Limited will be subsequently wound down and dissolved once the LLP wind down process is complete.

For that matter, let’s note that the status of Lucid Markets Trading Limited on the UK Financial Services Register has been changed to “inactive”.

Lucid Markets was among the businesses in the “FXCM family”, which the broker has actively marketed for sale. In May last year, FXCM announced the sale of its stake in FastMatch to Euronext. Euronext subsequently increased its holding in FastMatch to approximately 97.3%. This happened after Euronext purchased the remaining shares owned by Dmitri Galinov, co-founding CEO of FastMatch.

FXCM has been disposing of non-core assets in order to raise funds to repay the $300 million to Leucadia (now known as Jefferies). Let’s mention a SEC filing which has shown that in August 2017, V3 Markets, LLC (V3), another of the businesses that FXCM has actively marketed for sale, sold certain intellectual property and fixed assets. An unnamed buyer paid $0.3 million in cash. Also, as part of the transaction, the buyer agreed to reimburse V3 for certain liabilities and contract costs incurred by V3 for a prescribed period of time before and after closing amounting to $0.2 million. In conjunction with the sale, V3 ceased its remaining operations.