Lucid Markets Trading posts $74.4m annual loss, as FXCM continues to market the business for sale

The loss after tax that Lucid Markets Trading posted for the year to December 31, 2016, is $74.39 million.

As FXCM continues with its efforts to repay the remainder of the loan due to Leucadia National Corp. (NYSE:LUK), there are a couple of businesses that the broker has been actively marketing for sale, including V3 Markets and Lucid Markets. That is why, we were curious to get some insight into the financial status of one of these businesses.

The financial report of Lucid Markets Trading Limited for the year to December 31, 2016, has just become publicly available on the UK Companies House service, showing that last year was far from rosy for the business.

First, let’s provide some clarification about the nature and structure of business of Lucid Markets Trading Limited, as per the company’s latest report. The principal activity of Lucid Markets Trading Limited is that of a holding company of Lucid Markets LLP (referred in the report as “LLP”), which is a UK-registered electronic market maker and trader in the institutional FX spot and futures markets. Lucid Markets Limited is a member of the FXCM Group of companies, being Global Brokerage Inc (NASDAQ:GLBR), formerly known as FXCM Inc, and its subsidiaries (FXCM Group).

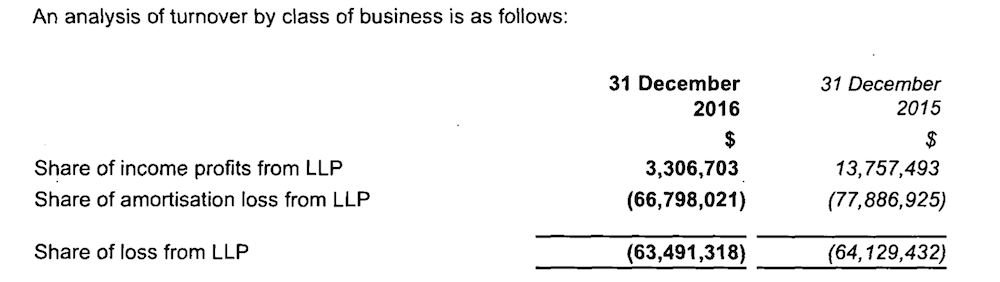

As a controlling member of Lucid Markets LLP, Lucid Markets Trading Limited is entitled to 100% of LLP’s profits and losses. This should explain the results for 2016, which include $63.49 million of share of the losses from the LLP subsidiary.

The loss after tax that Lucid Markets Trading posted for the year to December 31, 2016, is $74.39 million.

There are some statements regarding the future of the business in the report, confirming plans by FXCM to sell Lucid Markets.

In May this year, FXCM announced the sale of its stake in FastMatch to Euronext. As per the latest update from the broker about the repayment of the loan to Leucadia, FXCM has used $46.7 million of proceeds from the sale of its stake in FastMatch to pay down the Leucadia loan and expects additional paydowns in the coming months. About $66.7 million remains outstanding on the Leucadia loan.