Making traders successful: Detailed interview with Steve Nauta of Daticks

Brokerages need to ensure that traders keep trading with them for longer periods of time, and are able to maximize their performance in order to generate better returns for themselves and greater volumes for the broker. Steve Nauta explains in great detail how Daticks does exactly that.

Innovative methods of improving the performance of retail FX traders and ensuring that they achieve greater profitability and gain confidence in trading electronically whilst at the same time engendering longer lifetime client value and larger volumes for brokerages are vital these days.

In a retail FX environment in which the average deposit amount is $3,300 and the average client lifetime value is six months, yet the cost of acquiring new clients is between $1,200 and $1,500, this is a business critical consideration.

Retention automation solutions and various online educational tools are available and have been for some time, however the array of competition which has driven the margins down, as well as the increasing knowledge of the structure of the retail FX business among retail customers means that they drive a hard bargain these days and the matter remains that initial deposits, compared to the lifetime value and cost of acquisition are a major concern.

Today, FinanceFeeds spoke to Steve Nauta, Co-Founder of Daticks, which provides real time portfolio analysis with a per-account drill down facility, scenario analysis based on trading data which is designed to boost trading performance, as well as hosting live contests in which traders can win cash prizes on a monthly basis based on a risk adjusted return.

Mr. Nauta is a seasoned FX industry executive. Based in Grand Rapids, Michigan, home to various specialists in this business, he has senior executive tenures at GFT behind him as well as at NFA and CFTC regulated spot FX brokerages GreenTrust Capital Management and GloCap Markets where he was Managing Principal.

Adding a competitive element to networks of retail traders is an interesting alternative to standardized systems such as social trading. Do brokerages that partner with Daticks find this to be an effective means of increasing trading volume as well as customer lifetime value?

This is something we are currently evaluating. We expect it to be true. Instead of just increasing trading volume with a trading contest, our aim for brokers is increased positive trading volume.

With a risk adjusted return winning metric and future prize categories based on improved trading behavior, we believe this will lead to better traders, greater trading volume and improved retention for brokers. This will also lead to their clients having a much more positive experience with the broker.

How does Daticks integrate with retail FX brokerages, and how is it capitalized?

We are beginning to expand our offering by speaking directly with brokers that are looking to differentiate themselves from other brokers and offer something to help their clients improve.

Up to this point we have chosen to setup connections with MetaTrader 4 and NinjaTrader due in part to our experience with them and the demographics they serve. We will continue to do this with other brokers and platforms. If a broker or platform not currently in our pipeline would like us to integrate with them we are glad to speak with them on how best to work with them.

We offer a way for brokers to generate additional recurring revenue by offering us to their client base. It is a win-win situation for a broker. They help their clients by offering something that can help them succeed and possibly win cash prizes.

At the same time, they generate recurring revenue from a product add-on, generate increased positive trading volumes and retain their clients longer.

Let’s take a look at scenario analysis. How does Daticks reduce drawdowns and increase effectiveness for retail FX traders?

At the most basic level, our scenario analysis calculates the performance of a trader’s account for only those trades where the specific metric is above the chosen threshold. This assumes the trader either traded the minimum trade size available through their broker or traded in a SIM account (coming soon) when the metric was below the threshold.

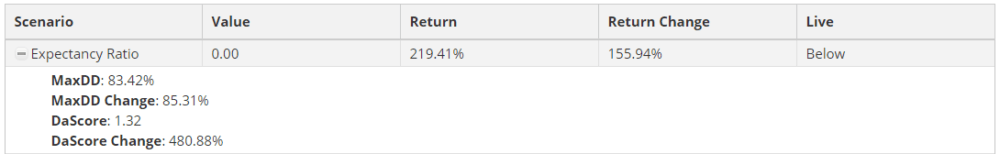

We calculate numerous trading scenarios for our traders. Once a trader picks their scenario, it is as simple as trading as they normally would when the “Live” column is highlighted in green and says “Above.” Then trading the minimum size allowed by the broker when it says “Below.”

Our aim is to use various statistical measures to detect periods that tend to be profitable. When a trader is in one of these periods, they will trade their strategy as they normally do. Some traders add on leverage during these periods in an attempt to “juice” their returns (Daticks is not recommending the use of leverage).

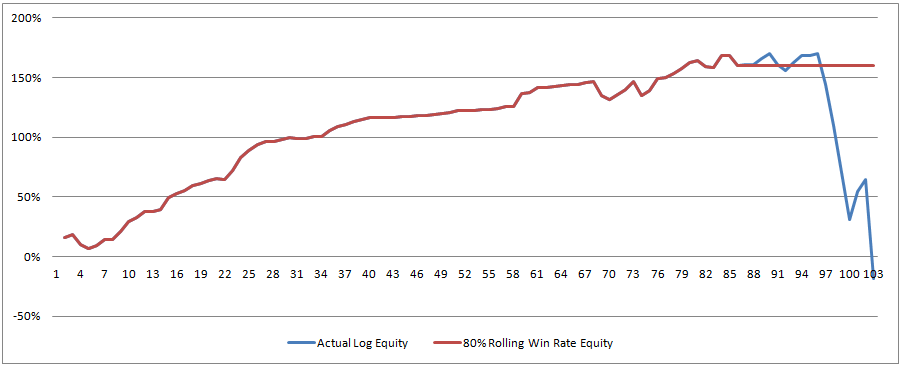

If the metric is showing “Below” (as in the image above), traders can use this as an early warning that they are about to enter a drawdown. If this is the case, it makes sense to either stop trading or trade much less size.

We have a great example of a user that should have heeded this warning when trading a high win-rate strategy. This trader went from being up over 170% in his account, to going debit with his broker. If he had followed our win-rate scenario (or almost any of the other scenarios we offer), he would have stopped trading while still being up about 160%. What a huge difference!

How many competitors per month currently participate in live trading contests using Daticks, and what is the assessment criteria for winners?

We are currently re-launching our trading contests after making some improvements due to our initial trader’s feedback. This includes speed improvements to our front-end display, layout improvements and additional extensive testing on the contest’s calculation engine.

We expect to have around 500 traders in our first live trading contest, beginning October 2, 2016. Then we expect that to ramp up as we add additional referral and broker partners.

Our clients have the ability to get their monthly subscriptions for free if they refer three traders to Daticks. This is not a one-time thing either. Each month, when three (or more) referrals continue to have active subscriptions, the client gets his or hers free. We believe this will help spur growth as well. Who doesn’t want something for free?

As our main focus is on helping our clients become more successful. So we employ a risk adjusted winning metric. Our DaScore is: return / 2* MaxDD and this is what we use for our winning criteria. This includes all performance during the contest month. Meaning, if a trader started the month with an open position balance or -$200 and closes the position for a loss of -100, +$100 would count for the contest score. All of our calculations are based on log returns.

In the relatively near future we plan on adding prize categories based on improvements made by the trader. As I said, we are focused on helping traders succeed and that means improvement as well. We will incentivize improvement with prize categories specific to that improvement. More to be announced . . .

How is the capital raised for providing cash prizes to winners of trading competitions, and is it a measurable incentive with regard to volume and subscriptions of traders competing in the contest compared to the amount paid to a winner?

Prize capital will come from subscriptions to our service. We will initially pay out to the top five places based on the highest DaScore. As our company and user base grows we expect to add additional paid places and categories.

Along with the above, we intend our competition to be something that 1) helps traders trade successfully, 2) offers traders multiple ways to win and 3) allows for a good number of traders to win on a monthly basis.

Being able to view portfolios in one centralized location is a very interesting feature. How does this work, and does it span multiple accounts with multiple brokerages?

Correct, our clients are able to link as many accounts to their dashboard as they would like. Currently we support all MT4 brokers and they can link multiple accounts at multiple brokers. When we complete our NinjaTrader connection, our users will be able to link accounts across multiple brokers and platforms.

Once a user links multiple accounts we automatically calculate statistics and an equity curve for each account separately as well as the combined portfolio. A user just has to select the account or portfolio from the dropdown to choose what data they would like to view.

For our monthly trading contest, each live trading account a user links to their dashboard is counted towards the contest. So, if a trader is trading different strategies at different brokers they can include them all in our trading contest.

It is of great interest that Daticks has partnered with NinjaTrader. Do you think that alternatives to MetaTrader 4 and its EAs such as NinjaTrader with Daticks are beginning to take market share, especially in regions where automated and social trading has been popular for many years?

I think NinjaTrader is an excellent platform that allows a trader to do pretty much whatever they want to with regards to programming. I have personally used it in the past for research and trading and found it very straight forward to use.

If, or once they open their NinjaTrader Brokerage to more forex brokers I do believe they can start eating into other platforms market share. Traders want platforms that are simple to use. NinjaTrader allows them to setup custom strategies without coding. This will be a welcome change for traders that have had to purchase EAs in the past for lack of programming ability.

What is Daticks’ next innovation for the coming year?

We will continue to research what factors lead to positive trading and look forward to sharing that with our community. We will also incentivize traders to trade towards those factors in their trading with our trading contests. If we can help traders be more successful and help fund part of their trading with contest winnings we will be very proud of our work.