MetaTrader 5 advances its hedging functionality

The MetaTrader 5 platform was originally designed for trading within the netting position accounting system. MetaQuotes has now added a new netting system to the platform which allows having only one position per financial instrument meaning that all further operations at that instrument lead only to closing, reversal or changing the volume of the already […]

The MetaTrader 5 platform was originally designed for trading within the netting position accounting system.

MetaQuotes has now added a new netting system to the platform which allows having only one position per financial instrument meaning that all further operations at that instrument lead only to closing, reversal or changing the volume of the already existing position.

In order to expand the service available to retail Forex traders, MetaQuotes has added the second accounting system which is hedging. Now, it is possible to have multiple positions per symbol, including oppositely directed ones. According to MetaQuotes, this paves the way to implementing trading strategies based on the so-called “locking” — if the price moves against a trader, they can open a position in the opposite direction.

Since the new system is similar to the one used in MetaTrader 4, MetaQuotes considers that it will be familiar to traders.

Until now, MetaTrader 4 has remained the trading platform of choice among brokers which use the MetaQuotes system in many regions apart from Russia, where MetaTrader 5 has gained a degree of popularity. The MetaTrader 4 platform accounts for over half of all retail platform usage globally, and despite the MetaTrader 5 platform having been available for quite some years now, it has made very few steps toward replacing the original and favorite. With the new functionality, it could perhaps bridge the gap between familiarity and new features.

At the same time, traders will be able to use the functionality of MetaTrader 5’s fifth version which includes filling orders using multiple deals (including partial fills), multicurrency and multithreaded tester with support for MQL5 Cloud Network, and much more.

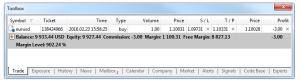

Now, traders can use one account to trade the markets that adhere to the netting system and allow having only one position per instrument, and use another account in the same platform to trade Forex and apply hedging.

Impact of the system selected

Depending on the position accounting system, some of the platform functions may have different behavior:

Stop Loss and Take Profit inheritance rules change.

To close a position in the netting system, you should perform an opposite trading operation for the same symbol and the same volume. To close a position in the hedging system, explicitly select the “Close Position” command in the context menu of the position.

A position cannot be reversed in the hedging system. In this case, the current position is closed and a new one with the remaining volume is opened. In the hedging system, a new condition for margin calculation is available — Hedged margin.

New trade operation type – Close By

The new trade operation type has been added for hedging accounts — closing a position by an opposite one. This operation allows closing two oppositely directed positions at a single symbol. If the opposite positions have different numbers of lots, only one order of the two remains open. Its volume will be equal to the difference of lots of the closed positions, while the position direction and open price will match (by volume) the greater of the closed positions.

Compared with a single closure of the two positions, the closing by an opposite position allows traders to save one spread: In case of a single closing, traders have to pay a spread twice: when closing a buy position at a lower price (Bid) and closing a sell position at a higher one (Ask). When using an opposite position, an open price of the second position is used to close the first one, while an open price of the first position is used to close the second one.