“Mind The Gap!” – The life and times of a man on the move Episode 72

We have begun our five events in five weeks! This week, FinanceFeeds held important events in London and Johannesburg. Here is the full report.

In this weekly series, I look back on what stood out, what was bemusing, amusing and interesting during my weekly travels, interesting findings within the FX industry and interaction with an ever-shrinking big wide world. This is purely observational and for your enjoyment.

A plethora of important events!

This week, the first of five global events organized and operated by FinanceFeeds began.

FinanceFeeds has always majored on the importance of invitation-only relationship building conferences and networking events as a vital component in the ability for all companies in all sectors of the electronic trading industry to be able to meet and do business with their most relevant and high quality audiences.

On Thursday evening, the first of five events in just five weeks took place in the global capital of financial services and the associated technological infrastructure that powers the entire world’s financial markets.

Produced in conjunction with FX and CFD brokerage technology provider Tools For Brokers, an expanding company which recently opened an office in London’s Square Mile, industry executives from across the world including European brokerages along with some of the leaders and founders of New York’s largest electronic trading businesses, analytics providers and listed derivatives firms convened to look at the sustainability of technological topography within today’s retail FX brokerages and how this can be improved.

Tools for Brokers expansion to London comes at a very important and poignant time for the entire FinTech and electronic trading business, as it brings the specialist FX industry tech vendors into the same realm as the large institutions, the world-leading infrastructure and best quality environment in the world at a time when Britain is about to become independent from the European Union and pave the way for brokerages to benefit from the FCA regulated high quality center of finance and its vast talent base by establishing in the UK to do global business.

Here are some of the highlights of the evening.

….. and then on to Johannesburg!

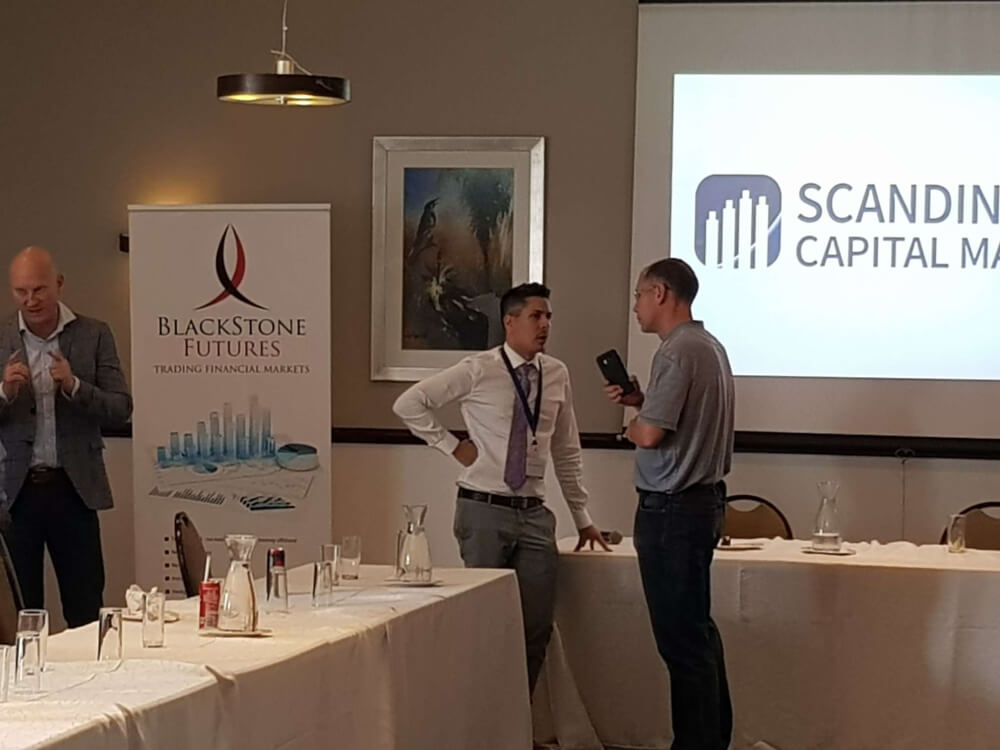

Just two days after this event in London, FinanceFeeds headed to Johannesburg to produce the FinanceFeeds Professional Trading Summit at the exclusive Bryanston Country Club in Sandton, one of Johannesburg’s most affluent neigborhoods.

Produced in conjunction with Swedish brokerage Scandinavian Capital Markets and South African futures company Blackstone Futures, the conference ran from 10.00am until the late afternoon, encompassing a discussion panel featuring some of the leaders of the retail FX industry in the Southern Hemisphere, along with vital analysis from Francis Hunt – known in the retail trading world for many years as “The Market Sniper”.

Speaking during panel discussions and individual keynote addresses to some of South Africa’s most experienced professional traders, IBs and FX portfolio managers were:

Francis Hunt, “The Market Sniper”. One of South Africa’s most successful traders will share his visions for better trading, and give insights into his ability to predict very important events.

Michael Buchbinder and Arif Alexander Ahmed, founders and Managing Partners, Scandinavian Capital Markets and inventors of the Valhalla Experience.

Nick Sproule, CEO and Co-Founder of Blackstone Futures, Johannesburg’s premier electronic trading and asset management brokerage for analytical and discerning traders.

Stephen Nefdt, Owner and CEO, Forex Wealth. One of South Africa’s longest established and most well respected Introducing Brokers.

Richard Goers, Senior Risk Analytics Consultant with international FX firms, and founder and owner of professional trading platform developer ManagedLeverage

Mark Strong, owner of Stronghold which is the Switzerland domiciled family office for the interests of the Strong family, and Head of Alternative Investment Fund Management at Optimum Management, an alternative Investment Fund based in Luxembourg focused on managing absolute return Global Macro/CTA strategies.

South Africa is a massively important and sophisticated market which is underserved by quality brokerages at the moment, hence the need to develop such conferences in the region.

Here is a full photograph montage of the day’s event:

There’s more to come this week!

FinanceFeeds is now heading to Sydney, Australia where, on November 21, we will produce the Sydney Cup FX Industry networking event, which brings together over 60 of Australia’s retail FX industry senior executives. It will take place at The Establishment, 252 George Street, Sydney from 6.00pm and will feature a keynote address by Tom Higgins, CEO of Gold-i.

Following that event will be the London Professional Traders Thought Leadership event on November 26 at Neo Barbican in Central London, where asset managers, algo developers, analytics and signal providers, HFT participants and hedge fund executives will gather from 6.00pm to forge important relationships. In conjunction with Pepperstone, this is a high quality event indeed and will feature a keynote address with worldwide renowned market analyst Chris Weston.

Heading back to Johannesburg for December 3, the Bryanston Country Club will once again be home to another conference by FinanceFeeds. This will feature professional traders and wealth managers from across South Africa, and more to come on that in the next few days!

Meanwhile, I wish you all a great week ahead and look forward to meeting you at these important leadership events in equally important regions of the world!