“Mind The Gap!” – The life and times of a man on the move Episode 74

Our industry executives speak out on the use of celebrities for promoting schemes. Will the powers that be listen? They should.

In this weekly series, I look back on what stood out, what was bemusing, amusing and interesting during my weekly travels, interesting findings within the FX industry and interaction with an ever-shrinking big wide world. This is purely observational and for your enjoyment.

Imitation is not always the best form of flattery

Oh dear. They’re at it again.

A few years ago, I got involved in contacting some advertising agencies in the UK and North America to ask them if they or the mainstream newspapers that they place premium advertising campaigns in actually bother checking the legitimacy of what is being published.

My findings were not far short of unbelievable, as large scale center-page promotions appeared in major, well respected printed material and across the internet sites of mainstream newspapers touting absurd schemes which had been constructed using bogus and unauthorized imagery, often featuring some of the world’s most famous celebrities, inferring that they had all made millions in various wonderful new ‘cannot go wrong’ moneymaking schemes.

My input actually had some effect, enlightening some PR agencies and – astonishingly – advertising departments of major newspapers, in effectively removing some of this drivel from the worldwide web.

It was, however, relatively short lived, as this phenomenon has reared its head once again.

Back-street hard sales tactics have been very dangerous for retail investors, and have created tremendous damage to the retail electronic investment market for genuine firms for quite some time, however when this is mixed with celebrity status, the risk and potential damage is even greater.

The lower end of the market is very jaded, and most smaller deposit value clients in peripheral jurisdictions are now all too aware of what the unregulated B book, binary options and odious cryptocurrency schemes are, most of them having experienced several hard sell calls from the same individual, in broken English, who has gone from one offshore bucket shop to another taking his ‘leads’ with him, and in some cases selling them to other white label brands.

Back then, it was binary options or some similar offshoot from the odious gambling sector, however today the message is the same but the dubious vehicle is different.

At least the tabloids and broadsheets are on the pace this time though..

It turns out, however, that not all commentators are this astute.

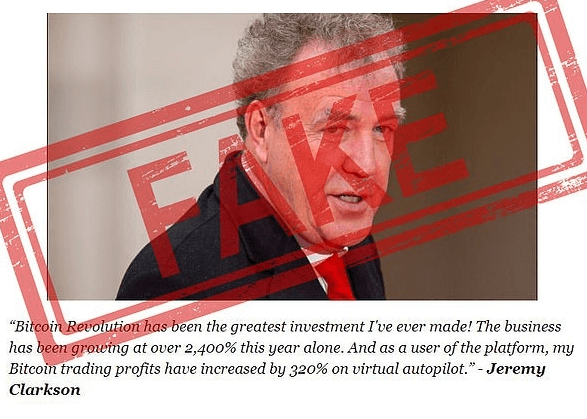

Recently, a bizarre and untrue commercial advertisement featuring Jeremy Clarkson, a British journalist and reporter who I have been an avid fan of ever since the mid 1980s when he contributed to Performance Car magazine via his own column ‘Chattels’ which was the first ever diversion from the plain, fact-and-figure orientated reporting style of the time, into charismatic social observations and extremely clever commentary on all aspects of life and society which all was somehow related to the subject in hand.

A mentor for the command and use of the poetic and versatile English language to me as a mid-teen wishing to expand my abilities, I took to Jeremy Clarkson’s wit and substance, viewpoints, observations and intoxicatingly sarcastic satirization of pretty much everything that existed.

Brilliant genius indeed, and certainly someone who would never fall for, or even worse, endorse a nonsense scheme.

However, some advertisers seem to doubt or collective intelligence. You have to see this to believe that it even exists.

This complete tripe had been the work of a scam company called “Bitcoin Revolution”, whose social media advertising referred to the mainstream adverts across reputable newspapers, along with false testimonials from names of people who do not exist.

We have all seen the false names used in those call centers in Israel and offshore, in which people with thick accents call themselves “David from Dublin, Ireland, UK” when addressing customers. Clearly their command of geography is aligned with their command of the English language, because I have always laboured under the apprehension that Ireland is not in the UK.

The interesting aspect here is that nobody seems to be getting sued for misrepresenting a well recognized public media figure, or for falsifying statements that had never been made, which show absolutely outrageous and unattainable returns and encourage the uninitiated general public to think that if Mr Clarkson, a global figure with over 300 million viewers, is doing well out of this, then it must be fine.

Are these the same media entities that won’t allow properly regulated FX and CFD firms to advertise? Is this the same Google that indexes utter garbage such as this and yet restricts FX and CFD firms, all of whom are doing absolutely everything they can at great cost to ensure that their modus operandi and infrastructure is absolutely compliant and that customers get what can only be described as a first-class, very reasonably priced and highly advanced trading experience?

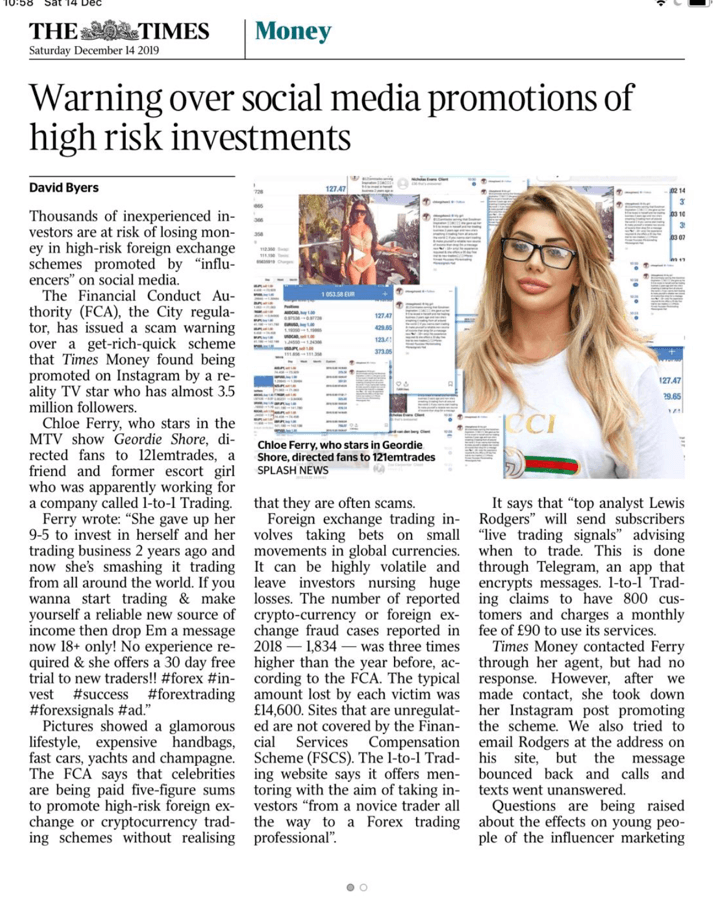

Dan Moczulski a senior executive in our industry yesterday spoke out about this on social media. He said “One of the first articles I have seen highlighting the use of social media influencers (in this case Chloe Ferry of Geordie Shore) to promote unregulated FX services. Surely this can’t end well.”

This particular executive leads a company which makes FX technology and market integration systems and has worked in management positions for the major British FX and CFD giants for many years during his quarter-decade career in this industry.

He refers to the article in the Times exposing how celebrities are used as false prophets for bad schemes. Responses from our industry’s executives to this were huge, and often valid. I wish the regulators would listen to us properly on this issue and hold our industry in the high regard that its leaders deserve.

We all know the psychology behind this.

Two years ago, Simon Cowell was the victim of the impostors. At that time, his falsified endorsement related to a ‘get rich quick’ affiliate auto-trading scheme, for which I immediately took the advertiser to task on. I even spoke to Mr Cowell’s agent who had absolutely no idea that Mr Cowell’s name had been used for this purpose and was extremely grateful.

He seemed to be quite aware of potential abuses of big names to create a success by association method of scamming people, but when I explained the full extent of these bitcoin or binary schemes, he was actually shocked.

In Britain, Simon Cowell is not only a very well known television personality, but a hugely influential figure, his prime-time talent shows Pop Idol, The X Factor, and Britain’s Got Talent, and on the other side of the Atlantic, American Idol, X Factor and America’s Got Talent, garner hundreds of thousands of dedicated viewers, many of which aspire to become famous and rich, and hale from very humble beginnings.

Haling from humble beginnings and aspiring to become rich and famous very quickly at the hands of a formulated media and celebrity package is, whilst having some working class romanticism, an absolute formula for disappointment, and for many, tremendous loss as all hope is piled high into a dream that is promised yet often does not materialize, resulting in zero substance except for the orchestrator.

Where have we seen this set of circumstances before?

Binary options, bitcoin and affiliate marketing programs that promise extremely high returns for small investments to a retail audience unfamiliar with the world of financial markets, that’s where.

The marketing message behind reality competition shows such as X Factor resembles that of binary options and Bitcoin investment in several ways. It appeals to the dejected, the lost and those wishing to realize a dream very quickly without having to master anything.

A childhood at a very difficult private school with high academic standards and tough teachers followed by a 7 year university course at an Ivy League or Red Brick university before completing an internship and only then beginning to earn a salary, or five minutes behind a microphone on a stage watched by millions of hopefuls in a vain attempt to gain a multi-million dollar record deal and eternal fame?

Which route does the uninitiated take?

Several years of studying algorithms, computer science and applied mathematics before making several self-initiated yet calculated steps into the financial markets, documenting it along the way until a degree of understanding is reached, risking one’s own capital and then joining an institutional or interbank trading desk for a large company that wants results, or just sign up to a scheme that promises massive returns with zero experience and can be done from home without any input?

Which route does the uninitiated take?

The latter choice of both of the scenarios often leads to disappointment and loss.

Simon Cowell has, whilst entertaining millions and knowing what will make a commercial success, known to revel in disappointment as part of his orchestration of a ‘get famous quick’ TV scheme for young hopefuls chasing their dreams which more often lead to the social security office in Halifax rather than the back stage office in Hollywood.

Combining Bitcoin, affiliate marketing and a binary options-type zero-sum you-against-the-house execution system, it is being touted as a solution to wealth creation, with bold and unbelievable statements such as ‘people are quitting their jobs using this system to make an average of £450 per day’ alongside photographs of Mr Cowell next to a 2017 Rolls Royce Phantom with dealer stickers displaying ‘Rolls Royce Motor Cars Beverly Hills’ to create a false sense of security in that someone this influential with such a high rolling lifestyle is endorsing it.

It was clear at the time that Mr Cowell has never even heard of such a scheme, let alone been party to it.

Karamba, which has no provenance, is mentioned in some very dubious press as having been described by Mr Cowell in September thus: “These are hard economic times and this could be the solution everyone has been waiting for,” Cowell said. “We’ve never had this opportunity in history. People can gain an enormous amount of wealth in a very short time using Karamba.”

Mr Cowell was then said to have continued “When I first heard about it, I knew I had to be a part of it. We’re going to change the world’s economy forever. This will help thousands of people change their lives, also. It’s great business.”

This is why: “A new economy emerged and 99.9% of the world is not aware of it. Times are tough, taxes are high and the jobs are scarce. This program gives you access to this new economy and an opportunity to be your own boss. Really anyone can start taking advantage of it and make thousands from their own home,” Mr Cowell said back in September according to these bogus reports.

Yes, and I’m a hobgoblin.

Wishing you all a super week ahead.